The committee’s report stated that the committee was exploring ways in which capital flows through IFSC can be enhanced and support the development of innovative financial products in the area of green and sustainable finance

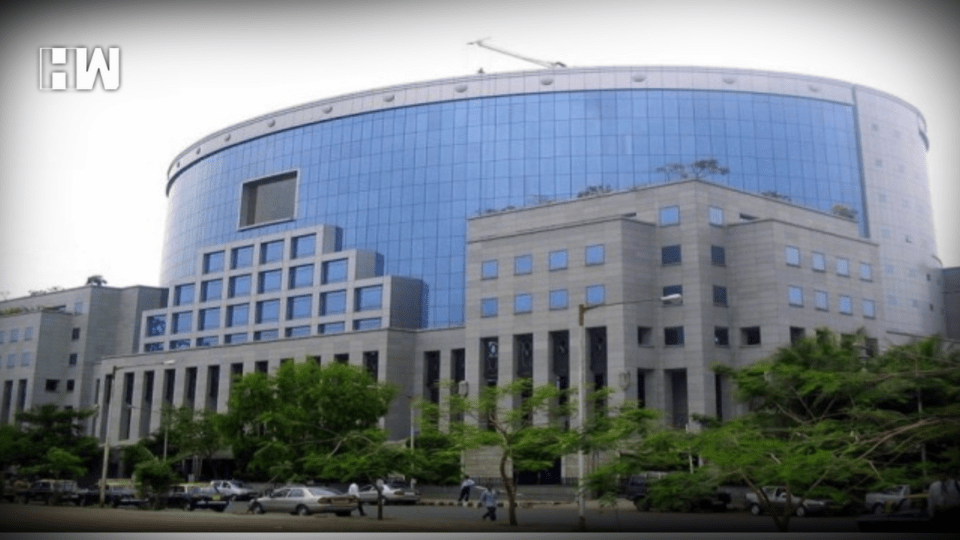

New Delhi: The International Financial Services Centres Authority (IFSCA) at the GIFT City had constituted a committee to file a report on sustainable finance. The panel had given the report to the Authority recently.

The main focus of the committee, which is headed by CK Mishra, the former secretary of the ministry of environment, forest and climate change, is to align the IFSCA regulations with international best practices.

Some of the recommendations by the committee are sustainable green, green products, issuance of sovereign green, green bonds via IFSC, innovative sustainable finance products, voluntary carbon market, sustainable finance for micro small & medium enterprises (MSMEs), enabling de-risking mechanisms, developing a voluntary carbon market and promoting green fintech, said an official statement.

The committee’s report stated that the committee was exploring ways in which capital flows through IFSC can be enhanced and support the development of innovative financial products in the area of green and sustainable finance.

Sustainable green products are used to raise money to finance new or refinance existing, green projects or activities. The money raised must be used for these activities, which can be for environmental and social benefits such as greenhouse gas emission reductions or biodiversity conservation.

The issuance of sovereign green bonds through IFSC would further validate the green bond market, leading to stronger bids, larger order books, increased pricing leverage and a higher quality investors base. In addition to this, the ministry of finance (MoF) should consider enabling sovereign masala bond issuances to be listed at IFSC to broaden the investor base for India’s sustainability transition without taking on currency risk.

A green bond is a fixed-income instrument designed to support specific climate-related or environmental projects. Green bonds may come with tax incentives to enhance their attractiveness to some investors. Masala bonds are bonds issued outside India but denominated in Indian rupees, rather than the local currency.

Also Read: Pawan Khera reacts to attack on Congress tribal leader Anant Patel in Gujarat’s Navsari

Some of the innovative sustainable finance products are weather derivatives, green securitisation and labelled bonds. Weather derivatives are used by corporates to hedge against weather-related / climate risks. Labelled bonds are the products, which are like the existing green bonds, but with a more focused use of proceeds.

The voluntary carbon market enables individuals, governments, NGOs, and businesses to voluntarily purchase carbon credits to offset their investments. Credit carbon market deals in the sale and purchase of carbon credits in spot and derivative markets. These markets are created to help companies reduce greenhouse gas (GHG) emissions at a lower price.

(Except for the headline, this story has not been edited by HW News staff and is published from a syndicated feed.)

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.