Presenting the Budget, Nirmala Sitharaman said, “The government has proposed to reduce the highest surcharge rate from 37% to 25% under new tax regime”

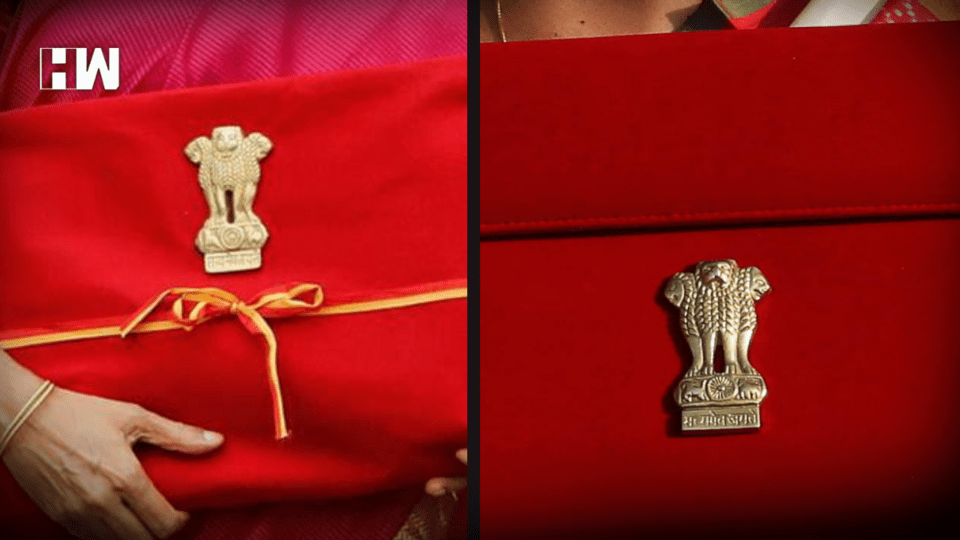

Mumbai: Finance Minister Nirmala Sitharaman said that under the new tax regime, the government has enhanced the income tax exemption limit up to Rs 7 lakh.

Those individuals earning between ₹2.5 lakh and ₹5 lahks have to pay a 5 percent tax. Income between ₹5 and 7.5 lakh is taxed at 10 percent, while those between ₹7.5 and 10 lakh at 15 percent. Those earning between ₹10 and 12.5 lakh have to pay tax at the rate of 20 percent, while those between ₹12.5 and ₹15 lakh have to pay at the rate of 25 percent. Income above ₹15 lakh is taxed at 30 percent.

Presenting the Budget, Nirmala Sitharaman said, “The government has proposed to reduce the highest surcharge rate from 37% to 25% under new tax regime.”

The income tax returns processing period has been reduced by 16 days.

Nirmala Sitharaman said, “The government has introduced new Income Tax return (ITR) forms for easier filing of returns.” She added, “Benefit of lower tax rate of 15% to new cooperative societies.”

In the last Budget no changes were announced in income tax slabs.The salaried class is currently looking forward the income tax rebate because the present income slab and the tax rates under the regular tax system have not altered since FY 2017–18.

Also Read: Why India’s Budget Is Called A Union Budget? Which Law Plays A Key Role In Government Expenses?

The Finance Minister had, last month, defended the new income tax regime. She had stated it had not reversed any gains from the old regime’s simplicity. “If indeed there were gains of simplicity (from the old income tax regime), I want to assure they have not been reversed,” Sitharaman said in New Delhi. “For every tax assessee, it has 7, 8, 9, 10 exemptions. And with all that exemptions, the rate 10, 20, 30 per cent continues. It continues even today. We have not removed it. What we have done in the name of simplicity and to avoid harassment… removing harassment was what was aimed at when we brought in faceless tax assessment,” she added.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.