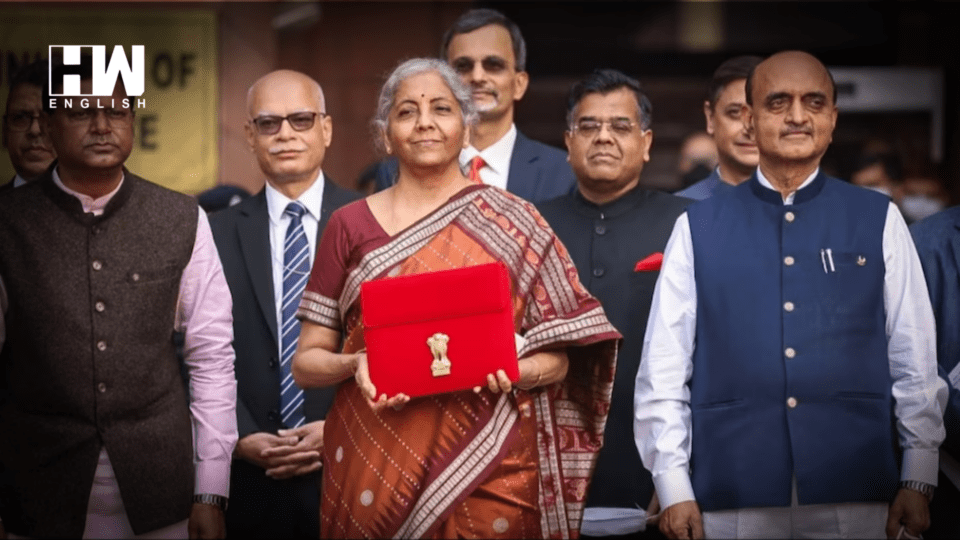

With an eye on upcoming Lok Sabha elections, Finance Minister Nirmala Sitharaman on Thursday presented a blueprint for Vikasit Bharat in her Interim Budget for 2024-25 without making any changes in direct and indirect taxes but with a resolve to achieve higher economic growth by giving a further push for the empowerment poor, women, youth and farmers. Their needs, their aspirations, and their welfare are the government’s highest priority because the country progresses when they progress. The Interim Budget contains a number of announcements and strategies indicating directions and development approaches for making India Viksit Bharat by 2047.

FM elaborated that this government’s humane and inclusive approach to development is a marked and deliberate departure from the earlier approach of ‘provisioning up-to-village level’. Development programmes, in the last ten years, have targeted each and every household and individual through ‘housing for all’, ‘har ghar jal’, electricity for all, cooking gas for all, bank accounts and financial services for all, in record time, she added. ‘’This Government is working with an approach to development

that is all-round, all-pervasive and all-inclusive. It covers all castes and people at all levels. She said, “We are working to make India a ‘Viksit Bharat,’’ she said.

FM announced that the capital expenditure outlay for the next year is being increased by 11.1 per cent to Rs 11,11,111 crore, which would be 3.4 per cent of the GDP. She said this is in the wake of building on the massive tripling of the capital expenditure outlay in the past four years, resulting in a huge multiplier impact on economic growth and employment creation.

As per the First Advance Estimates of National Income of FY 2023-24, presented along with the Finance Minister’s speech, India’s Real GDP is projected to grow at 7.3 per cent. This is also in line with the upward revision in growth projections for FY 2023-24 by the RBI (in its December 2023 Monetary Policy Committee meeting) from 6.5 per cent to 7 per cent, prompted by strong growth in Q2 of FY 2023-24.

The Indian economy has demonstrated resilience and maintained healthy macroeconomic fundamentals despite global economic challenges. The Indian economy has witnessed a profound positive transformation in the last ten years, and the people of India are looking ahead to the future with hope and optimism. She added, “Conditions were created for more opportunities for employment and entrepreneurship. The economy got a new vigour. The fruits of development started reaching the people at scale. The country got a new sense of purpose and hope”.

The Finance Minister informed that with the pursuit of ‘SabkakaSaath’ in these ten years, the Government has assisted 25 crore people to get freedom from multi-dimensional poverty and the Government’s efforts are now getting synergized with energy and passion of such empowered people.

The International Monetary Fund (IMF), in its World Economic Outlook (WEO), October 2023, has revised its growth projection for India for FY 2023-24 upwards to 6.3 per cent from 6.1 per cent projected in July 2023. This reflects increasing global confidence in India’s economic prowess at a time when global growth projection for 2023 remains unchanged at 3 per cent.

As per the IMF, India is likely to become the third-largest economy in 2027 (in USD at market exchange rate), and it is also estimated that India’s contribution to global growth will rise by 200 basis points in 5 years.

The Finance Minister stated that strong growth in economic activity has imparted buoyancy to revenue collections and pointed out that GST collection stood at ₹1.65 lakh crore in December 2023.This is the seventh time that gross GST revenues have crossed ₹1.6 lakh crore benchmark.

She said coming to 2024-25, the total receipts other than borrowings and the total expenditure are estimated at Rs 30.80 and 47.66 lakh crore, respectively. The tax receipts are estimated at Rs 26.02 lakh crore. The fiscal deficit in 2024-25 is estimated to be 5.1% of GDP while continuing the fiscal consolidation to bring it down to 4.5% by 2025-26. Similarly, the gross and net market borrowings through dated securities during 2024-25 are estimated at Rs 14.13 and 11.75 lakh crore, respectively, and both will be less than that in 2023- 24.

FM said the scheme of a fifty-year interest-free loan for capital expenditure to states will be continued this year with a total outlay of Rs1.3 lakh crore. A provision of seventy-five thousand crore rupees as a fifty-year interest-free loan is proposed this year to support the milestone-linked reforms of Viksit Bharat by the State Governments.

Pointing out some of the bright spots of the economy, the Finance Minister informed that the Revised Estimate of the total receipts other than borrowings is Rs 27.56 lakh crore, of which the tax receipts are Rs 23.24 lakh crore. The Revised Estimate of the total expenditure is Rs 44.90 lakh crore. The revenue receipts at Rs 30.03 lakh crore are expected to be higher than the Budget Estimate, reflecting strong growth momentum and formalization in the economy.

FM stated that the gross and net market borrowings through dated securities during 2024-25 are estimated at Rs14.13 and 11.75 lakh crore, respectively, and both will be less than that in 2023-24.

She announced that the FDI inflow during 2014-23 was $596 billion, marking a golden era, and this is twice the inflow during 2005-14. To encourage sustained foreign investment, we are negotiating bilateral investment treaties with our foreign partners, in the spirit of ‘first develop India’, she added.

FM said PM Mudra Yojana has sanctioned 43 crore loans aggregating to Rs 22.5 lakh crore for entrepreneurial aspirations. It may be mentioned that thirty crore Mudra Yojana loans have been given to women entrepreneurs.

Making a slew of announcements, FM said the Government will pay utmost attention to making the eastern region and its people a powerful driver of India’s growth; PM Awas Yojana (Grameen) is close to achieving the target of three crore houses and two crore more houses will be taken up in the next five years to meet the requirement arising from increase in the number of families. Similarly, through rooftop solarization, one crore households will be enabled to obtain up to 300 units of free electricity every month.

Pradhan Mantri Kisan Sampada Yojana has benefitted 38 lakh farmers and generated 10 lakh employment. Pradhan Mantri Formalisation of Micro Food Processing Enterprises Yojana has assisted 2.4 lakh SHGs and sixty thousand individuals with credit linkages.

FM announced that for our tech-savvy youth, this would be a golden era, as a corpus of rupees one lakh crore will be established with a fifty-year interest-free loan. She said the corpus will provide long-term financing or refinancing with long tenors and low or nil interest rates. This will also encourage the private sector to scale up research and innovation significantly in sunrise domains.

‘’Empowering Amrit Peedhi, the Yuva – Our prosperity depends on adequately equipping and empowering the youth!! The National Education Policy 2020 is ushering in transformational reforms. PM Schools for Rising India & PM Shri are delivering quality teaching. Skill India Mission has trained 1.4 crore youth, upskilled and reskilled 54 lakh youth and established 3,000 new ITIs. A large no. of institutions of higher learning, namely 7 IITs, 16 IIITs, 7 IIMs, 15 AIIMSs and 390 universities, have been set up,’’ said FM.

For Railways, three major economic railway corridor programmes will be implemented: mineral and cement corridors, port connectivity corridors, and high-traffic density corridors. Moreover, forty thousand normal rail bogies will be converted to the Vande Bharat standards to enhance the safety, convenience and comfort of passengers.

In the Aviation Sector, the number of airports has doubled to 149, and today, five hundred and seventeen new routes are carrying 1.3 crore passengers. Indian carriers have proactively placed orders for over 1000 new aircraft.

FM announced a slew of initiatives to promote green energy, including setting up of coal gasification and liquefaction capacity of 100 metric tonnes by 2030, phased mandatory blending of compressed biogas in compressed natural gas for transport and pinned natural gas for domestic purposes to be mandated. In addition, the governments will provide all possible assistance for the development of the electric vehicle (EV) ecosystem by promoting manufacturing and charging facilities.

As far as the tourism sector is concerned, states will be encouraged to take up comprehensive development of iconic tourist centres, including their branding and marketing at a global scale, the establishment of a framework for a rating of the tourist based on the quality of facilities and services and long term interest-free loans will be provided to states for financing such development on a matching basis.

Sitharaman announced that the Government will form a high-powered committee for an extensive consideration of the challenges arising from fast population growth and demographic changes, and the committee will be mandated to make recommendations for addressing these challenges comprehensively in relation to the goal of ‘Viksit Bharat’.

The Finance Minister pointed out that the Prime Minister, in his Independence Day address to the nation in the 75th year of our Republic, said, “We commit ourselves to national development, with new inspirations, new consciousness, new resolutions, as the country opens up immense possibilities and opportunities”. It is our ‘KartavyaKaal’. She said, “Every challenge of the pre-2014 era was overcome through our economic management and our governance, and these have placed the country on a resolute path of sustained high growth”.

Sitharaman emphasized, “This has been possible through our right policies, true intentions, and appropriate decisions. In the full budget in July, our Government will present a detailed roadmap for our pursuit of ‘Viksit Bharat’.

No revision in taxes

No change relating to taxation has been proposed in the Interim Budget. The same rates for direct taxes and indirect taxes, including import duties, have been retained. However, to provide continuity in taxation, certain tax benefits to Start-Ups and investments made by sovereign wealth or pension funds, as also tax exemptions on certain income of some IFC units, have been extended by one year up to 31st March 2025.

Withdrawal of Outstanding direct tax demands

Sitharaman made an announcement to improve taxpayer services, which is in line with the government’s vision to improve ease of living and ease of doing business. There are a large number of petty, non-verified, non-reconciled or disputed direct tax demands, many of them dating as far back as the year 1962, which continue to remain on the books, causing anxiety to honest taxpayers and hindering refunds of subsequent years. The Interim Budget proposes to withdraw such outstanding direct tax demands up to Rs 25000 pertaining to the period up to financial year 2009-10 and up to Rs 10,000 for financial years 2010-11 to 2014-15. This is expected to benefit about a crore taxpayers.

Direct tax collections trebled.

Appreciating the taxpayers for their support, Sitharaman said that over the last ten years, the direct tax collections have more than tripled, and the return filers swelled to 2.4 times. She highlighted the fact the Government has reduced and rationalised the tax rates, due to which, under the new tax regime, there is no tax liability for taxpayers with income up to Rs. 7 lakh. She also mentioned an increase in the threshold for presumptive taxation for retail businesses as well as professionals. The Minister also mentioned a decrease in corporate tax rates for existing domestic companies from 30% to 22% and for certain new manufacturing companies to 15%. In her Interim Budget speech, the Minister said that in the last five years, the Government’s focus has been on improving tax-payer services, which has led to the transformation of the age-old jurisdiction-based assessment system, and the filing of tax returns has been made simpler and easier. The average processing time of returns has been reduced from 93 days in the year 2013-14 to a mere ten days this year, thereby making refunds faster, she added.

GST reduced the compliance burden

On indirect taxes, FM said that GST has reduced the compliance burden on trade and industry by unifying the highly fragmented indirect tax regime in India. Mentioning a recent survey conducted by a leading consulting firm, she said that 94% of industry leaders view the transition to GST as largely positive. In her Interim Budget speech, the Minister highlighted the fact that the tax base of GST has more than doubled and average monthly gross GST collection has almost doubled to Rs 1.66 lakh crore this year. States, too, have benefited. States’ SGST revenue, including compensation released to states in the post-GST period of 2017-18 to 2022-23, has achieved a buoyancy of 1.22.

FM said that the biggest beneficiaries are the consumers, as reductions in logistics costs and taxes have brought down the prices of most goods and services. Mentioning a number of steps taken in customs to facilitate international trade, she said the import release time declined by 47 per cent to 71 hours at Inland Container Depots, by 28 per cent to 44 hours at air cargo complexes and by 27 per cent to 85 hours at seaports, over the last four years since 2019.

Laying of White Paper

On the status of the Indian economy, the Union Minister said that in 2014, the responsibility to mend the economy step by step and to put the Governance systems in order was enormous, which she said was done by the Government successfully following its strong belief of ‘nation-first’. She assured that the crisis of those years has been overcome and the economy has been firmly put on a high sustainable growth path with all-round development. She announced that the Government will come out with a white paper on ‘where we were then till 2014 and where we are now, only for the purpose of drawing lessons from the mismanagement of those years’.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.