Activist Venkatesh Nayak, through the Right to Information Act, recently obtained the minutes of the 561st board meeting of the RBI which was held at 5.30 pm on November 8th 2016 – does that date sound familiar? – Yes it does. That was the same date Prime Minister Narendra Modi announced at 8 pm the government’s intention to ban ₹ 500 and ₹ 1000 notes – Demonetisation.

The minutes of the meeting, which have been confirmed as genuine by the RBI had warned the government that removing high-value cash was unlikely to stem the flow of black money in the system, because most black money is not held in the form of cash, but in the form of real estate assets and gold.

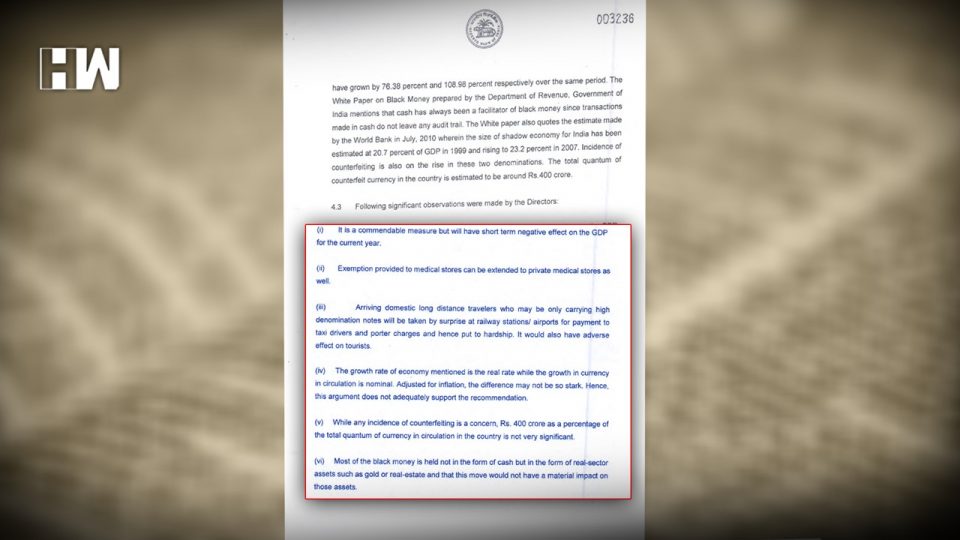

Among other reasons, the government’s logic behind the move was they claimed that between 2011-12 and 2015-16, there had been a steep rise in circulation of high value notes; with ₹ 500 notes growing at 76.38% and ₹ 1000 notes growing at 109%; while during the same period the economy had grown at 30%, thereby suggesting that so much cash facilitated black money transactions because it did not leave any audit trail. However, the observation made by the RBI was that the growth rate of the economy was the real rate i.e. inflation adjusted rate and hence it was lower, while the growth rate of currency circulation was nominal growth rate. Adjusted for inflation, the difference may not be so stark.

Another reason given by the government was that counterfeiting was on the rise and amounted to a value of ₹ 400 crore, however, the RBI noted that ₹ 500 and ₹1000 notes in circulation amounted to a value of ₹ 15,41,000 crore, and 400 crore as a % of total quantum is not significant.

In effect, the minutes of the meeting clearly showed that the RBI was not convinced by the government’s argument. Urjit Patel, the then governor, signed the demonetisation resolution 38 days after the exercise.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.