A potentially profitable investment destination is not attractive, if the very capital investment is at risk.

It was this week that three articles appeared in three different newspapers which spoke about India’s image as an investment destination to overseas investors. The first article wrote about the blots on India’s image, due to the lack of sanctity of commercial contracts and how easily does the government and the private sector, renege on a duly written/signed contract. It then mentioned the huge delays in enforcing such contracts in India, where the average time taken to get contracts enforced by the courts by resolving commercial disputes is 1445 days in India, as against 120 days in Singapore and 403 days in Indonesia. It rightly said that while in the overall EODB global rankings, our standing has improved considerably, however when it comes to enforcing contracts, our ranking competes with the likes of Zimbabwe and Afghanistan. It referred to the recent blatant cancellation of solar agreements by the Gujarat government, awarded to the likes of ADIA and Temasek merely because the government was getting better tariffs elsewhere. It was an audacious refusal by the government to honour a duly executed contract. It reflects stark system indifference to international investors and poor integrity, even at the institutional level in India.

It then spoke about the Government’s refusal to accept international arbitration awards as in the case of Vodafone and Cairn Energy. The author further debunks the myth about rising FDI in India, by clarifying that a large part of the FDI received in 2020 related to one single entity i.e. Reliance Industries Ltd. and that as a percentage of GDP, the FDI inflows stood at 1.8% in the case of India, as against 4.9% in the case of Vietnam and 2.1% in the case of Indonesia.

The next article was an interview with the regional head of DFC, USA which has invested in 200 projects in India since 1974 and which at present has an investment of $ 2.5bn in 50 ongoing projects in partnership with India’s private sector. The DFC head says that while India is in great need of foreign investment and has a huge number of educated/talented entrepreneurs, the government needs to reduce bureaucratic restrictions and adopt reforms to protect the foreign investors. He says that if done, it will create a welcoming environment for investors. The third article speaks about the vested interests of anti Indian lobbies in the West to tarnish India’s image and how they are building an anti India narrative taking advantage of the farmers protest, arrest of the likes of Disha Ravi and various journalists, on frivolous allegations of sedition.

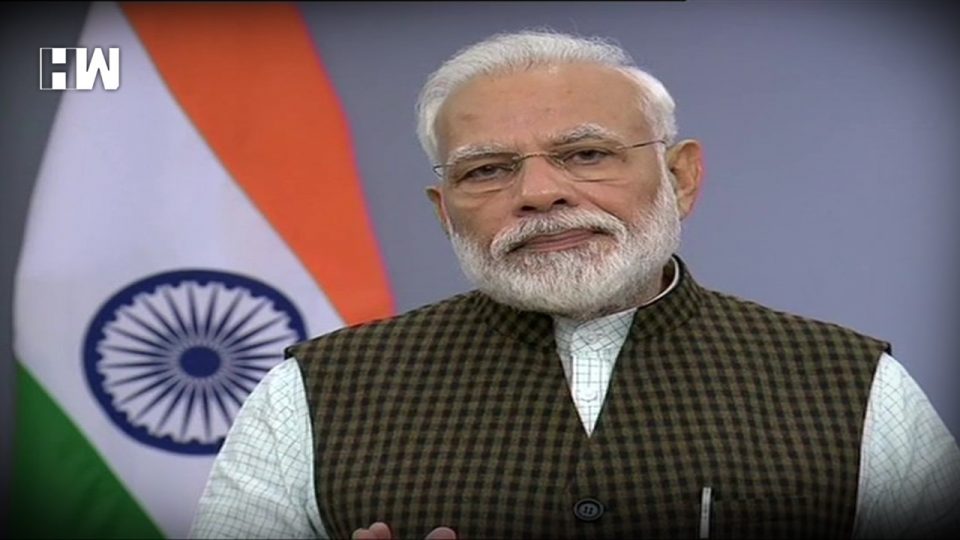

These articles about India raise a common question viz. is India a great investment destination, as the PM, FM and other ministers and babus often claim it to be. Do the often repeated claims of the FM, that with low tax rates, massive foreign investments should flow into India, truly appeal to the astute international investors? The reasons why India should attract foreign investment are many:

- Huge investment/development backlog and a need for funds.

- A solid and vibrant, inclusive democracy.

- A favourable demography that generates demand.

- Talented and determined entrepreneurs.

- Globally accepted and integrated nation.

- Global footprint of NRIs, our true brand ambassadors.

- Potential to be a low cost destination, for both manufacturing and services sectors.

- Rule of law and judiciary.

- A competitive tax rate, but with super complex laws.

The reality is that despite such massive/unique strengths of India, we just don’t get it right and become the most sought after global investment destination. That is to do with the fact that investors do not feel that their investment is safe and protected in India. Its because of a toxic combination of corruption, red tapism, non accountability and meddling by the babu and the neta, shoddy integrity reflected in refusal to honour contracts, complex and uncertain laws and infra deficiency and finally slow moving and insensitive courts that derail justice and do not protect investment. A potentially profitable investment destination is not attractive, if the very capital investment is at risk.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.