Mumbai | Benchmark Sensex buckled under selling pressure for the third straight day on Thursday, in step with a global sell-off triggered by the arrest of a top executive of Chinese telecom giant Huawei in Canada.

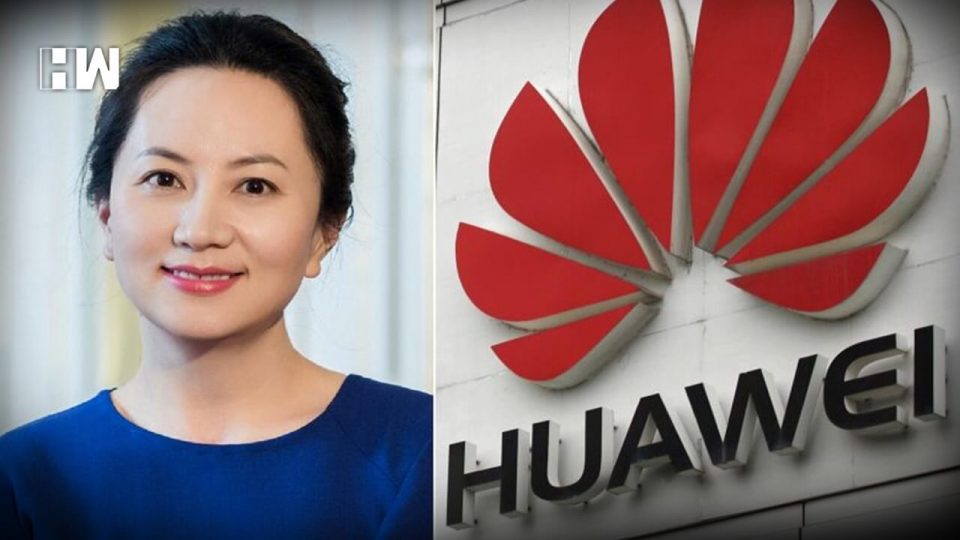

Asian markets nosedived after Huawei CFO Meng Wanzhou, who is also the company founder’s daughter, was arrested in Canada for extradition to the US for suspected Iran sanctions violations, dealing another blow to US-China relations.

The BSE Sensex plunged 572.28 points, or 1.59 per cent, to close at 35,312.13. Similarly, the broader NSE Nifty fell 181.75 points, or 1.69 per cent, to 10,601.15. All sectoral indices on the BSE and NSE ended in the red, led by metal, oil and gas, pharma and financial stocks. Sun Pharma was the lone gainer in the 30-share Sensex pack. A weakening rupee, which plunged below the 71 per dollar mark intra-day, and fresh foreign fund outflows further dented investor sentiment, analysts said.

“Capital markets had a rough day, as they are trying to navigate too many data points such as re-emergence of sharp weakness in Indian rupee, upcoming OPEC meeting outcome in terms of production cut, and upcoming results of five state assembly elections. The nervousness is quite evident, as there is sharp sell-off across the industries, and especially in those stocks where there are corporate governance concerns,” said Jagannadham Thunuguntla, Senior VP and Head of Research Wealth), Centrum Broking Limited.

Top index losers included Maruti, Tata Motors, Reliance Industries, Yes Bank, Adani Ports, Bharti Airtel, Asian Paints, ONGC, HUL, Kotak Bank, IndusInd Bank and Axis Bank, falling up to 4.63 per cent. Sun Pharma rose 1.57 per cent.

On a net basis, foreign portfolio investors (FPIs) sold shares worth Rs 357.82 crore Wednesday, and domestic institutional investors (DIIs) were net sellers to the tune of Rs 791.59 crore, provisional data available with BSE showed. Crude oil prices slipped below the USD 60 per barrel level amid a crucial meeting of Opec members. Elsewhere in Asia, Korea’s Kospi fell 1.55 per cent, Japan’s Nikkei dropped 1.91 per cent, Hong Kong’s Hang Seng shed 2.47 per cent and Shanghai Composite Index tumbled 1.68 per cent. In Europe, Frankfurt’s DAX shed 2.36 per cent and Paris’ CAC 40 fell 2.21 per cent in early deals. London’s FTSE too slipped 2.50 per cent.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.