These were created by the corrupt nexus of the net-babu-bankers and the borrower, where bad loans were knowingly given and banks were bankrupted

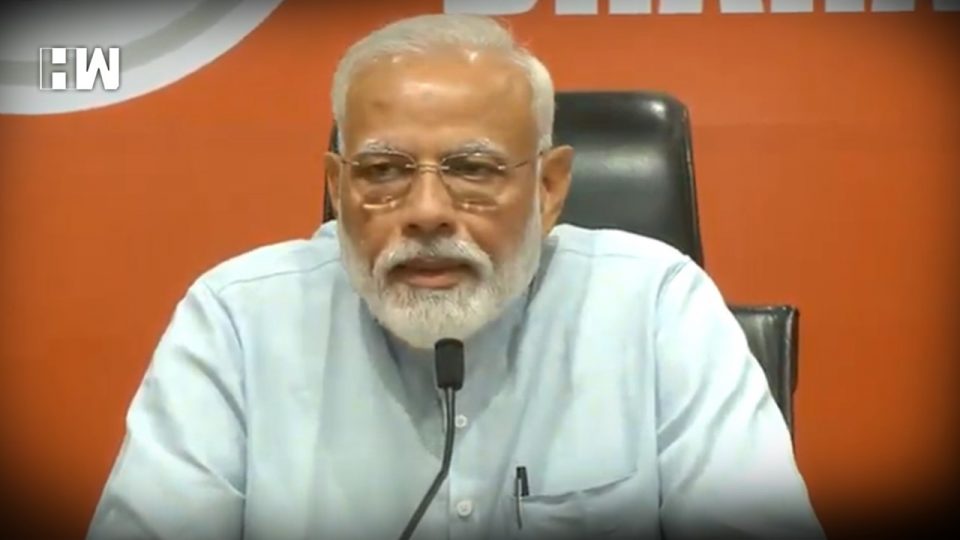

Mumbai: With the Indian economy continuing to slowdown and getting little support from banks by way of increased lending, the government has been desperate to kickstart bank loans, to energize a slumbering economy. It has undertaken what it calls banking reforms and has sought to resolve the crippling NPA crisis, through the IBC route. It has yet not enthused banks to lend more. In fact lending to corporates has gone down. While speaking at a summit recently, the PM announced that business decisions taken by bank officials will not be questioned. He said that the government will release guidelines on the scrutiny of any serving finance/banking expert. He reassured bank officials that we have come out of the old situation and that no one will question the genuine business decisions of bankers. The PM said that if a banker does not make a decision because he is afraid to do so, then the government cannot leave him insecure. He said that the government takes responsibility for the security of bankers and that is how the nation will move ahead. He spoke about recapitalizing banks by infusion of Rs.2.50 lac crores and the PSB bank mergers, which he says has made our banks much more stronger. He said that what India needs is strong banks and not too many banks.

While India’s continued economic slowdown is a matter of worry, so is the continued reluctance of banks to lend. With generous pumping in of fresh capital by the government into banks and household savings coming to banks in huge numbers, the banks are flush with funds. But instead of lending, particularly to new projects, banks have preferred to park their surplus funds with the RBI in very low interest-bearing securities. They have deposited about Rs.3 lakh crores with the RBI, in the past 6 months alone, instead of lending the same. The government, on the other hand, has been desperate to boost bank lending, as is evident from its various schemes, the latest being the loan melas where terms of thousands of crores have been disbursed to unworthy borrowers. The government is copiously supplying funds, but neither is the demand for loans buoyant nor is the disbursal by banks. The reality is that there are numerous reasons today why the bankers are reluctant lenders, due to which lending by banks has contracted.

- Trust is a huge factor and corporate balance sheets and businesses have not been cleansed enough, for banks to feel safe and secure in their lending activity. With each ILFS, DHFL, RCom, RCap, Jet Airways, Bhushan Steel, etc., the banker’s trust in the integrity of entrepreneurs, their balance sheets, business, auditors and ratings get eroded further and since such corporate frauds and failures continue, bankers remain risk-averse.

- The other reason that bankers remain risk-averse and reluctant lenders is to do with the overall state of the economy and the stressed balance sheets of borrowers. Even the government’s own balance sheet is stressed today such that banks are unwilling to even lend to NHAL for its infra projects. With so many sectors deep in stress, the bankers are bound to be risk-averse.

- Due to such risk aversion the terms of lending have become so stringent that many borrowers get needed out, as not being eligible to borrow. Few borrowers are able to comply with the margin and collateral security requirements imposed by banks, thus reflecting in the receding growth in bank loans.

- With huge frauds exposed and investigation/prosecution by criminal agencies being in an overdrive mode, there is a dip in collusive lending and phone influenced lending. We do not think that such phone lending to cronies has stopped, but we think that it has dipped at present, perhaps waiting to be scaled up again later. Large ticket loans were often given in this manner. How else do you explain huge loans by banks to Jet Airways that made losses in 11 out of the past 12 years or to a Bhushan Steel which had a net worth of Rs.5000 crores but got loans of over Rs.50000 crores? These kinds of big-ticket loans have ebbed at the moment, even though it continues in the likes of Mudra loans.

- The corporates performance has deteriorated and there are many firms that are over-leveraged, such that they are unable to even service the interest cost of loans. As at 31.3.2019, about 625 firms with loans of over Rs.6 lakh crores, did not earn enough money to even pay interest to banks. As the economy slows down and impacts corporate performance, this situation will only deteriorate further. Bankers thus remain cautious in lending to corporates.

- With delinquent bankers being investigated/punished, though with a poor conviction rate, by the three C’s ie. CBI, CVC and courts, many bankers have decided to go slow on their lending activities and decisions. They prefer to not lend than face the music if any lending decision goes bad. For them, it is better to sit on excess liquidity than lend.

It is this fear of bankers that the PM was addressing and seeking to assuage. The reality of banking is that like any commercial activity, a few decisions are bound to go bad. But in India, a little too many have gone bad and have resulted in the mountain of NPAs that have stalled our growth. These were created by the corrupt nexus of the net-babu-bankers and the borrower, where bad loans were knowingly given and banks were bankrupted. That factor may look receded at the moment but lurks in the background, as no net/babu/banker is unwilling to give up this lucrative illegal platform of lending, for dirty gains. That remains unaddressed by the PM.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.