On March 5, RBI had placed YES Bank under moratorium. The Bank had given out large loans to business which it had then failed to recover.

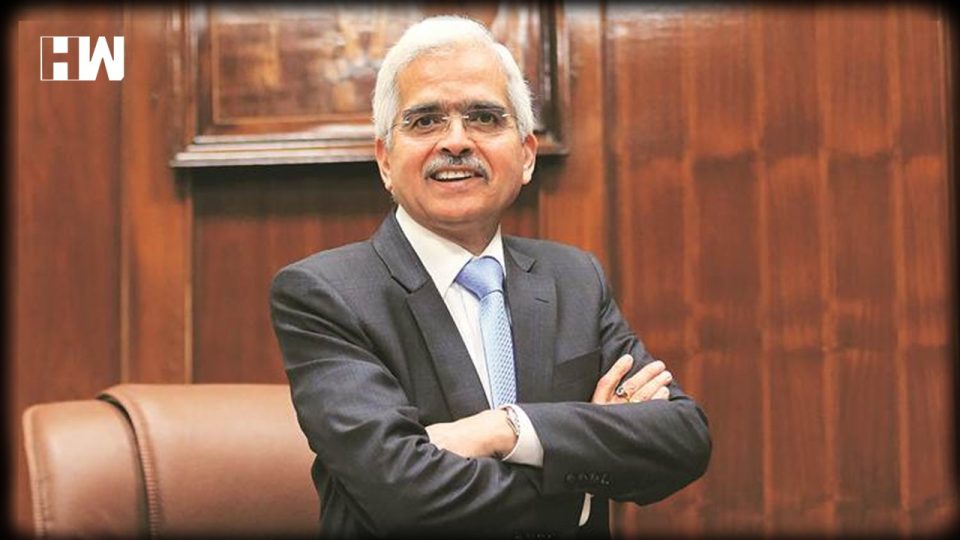

Mumbai| Reserve Bank of India (RBI) Governor Shaktikanta Das on Monday announced that the moratorium on Yes Bank will be lifted on Wednesday, March 18, 2020.

The central bank governor said that swift action has been taken by the government and central bank to resolve Yes Bank crisis and also assured that the depositor’s money in the struggling private sector lender is safe.

He also said that in case of requirement, RBI is also willing to provide liquidity support to Yes Bank.

Das reiterated depositors’ money is absolutely safe and that there is no need for panic withdrawal.

“I would like to convey to the depositors of Yes Bank, through you, that their money is completely safe and there is nothing to worry. There is no reason for any undue worry,” Das said during a press conference.

“The underlying theme on which the scheme is based is to protect the depositors’ interest,” he said.

Das also said that the new Yes Bank board will take on March 26.

The hurriedly called press conference comes amid widespread call for a rate cut following similar steps by the world’s leading central banks. The US Federal Reserve has cut the policy rates to near-zero levels in a span of 10 days.

Also Read: Hundreds march to PM Modi’s house with hands tied up to avoid blame for violence

The Bank of England has also slashed the rates by 50 basis points, and so did the European Central Bank.

If a rate cut is announced, this will be first inter-meeting rate reduction since the monetary policy committee was instituted in February 2016.

In a tweet, the crisis-ridden bank said, “We will resume full banking services from Wed, Mar 18, 2020, 18:00 hrs. Visit any of our 1,132 branches from Mar 19, 2020, post commencement of banking hrs to experience our suite of services. You will also be able to access all our digital services & platforms”.

We will resume full banking services from Wed, Mar 18, 2020, 18:00 hrs. Visit any of our 1,132 branches from Mar 19, 2020, post commencement of banking hrs to experience our suite of services. You will also be able to access all our digital services & platforms@RBI @FinMinIndia

— YES BANK (@YESBANK) March 16, 2020

RBI and the government had announced a reconstruction plan for YES Bank on March 6. The plan involved SBI investing in Yes Bank and effectively owning a 49% stake in the bank. The withdrawal limit was lifted shortly afterwards.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.