According to persons familiar with the situation, Russia is offering India huge discounts on direct oil sales as rising international pressure reduces demand for its barrels elsewhere following the invasion of Ukraine.

The sanctions-hit country is offering India discounts of up to $35 per barrel on its flagship Urals grade to entice it to lift more shipments, according to the people, who asked not to be identified discussing private discussions. Headline Brent prices have risen by around $10 since then, predicting a further drop from present levels.

They claimed Russia wants India to take 15 million barrels of oil contracted for this year as a start, and that conversations are going place at the government level.

Asia’s second-largest oil importer is one of a small group of countries that have increased their reliance on Russian crude despite international pressure and sanctions. Following the invasion of Ukraine, Russian barrels have been flowing to Asia in increased amounts as purchasers in Europe and the United States reject the supply. The main purchasers have been India and China.

They added that Russia has also allowed rupee-ruble-denominated payments using its messaging system SPFS, which might make commerce more appealing to India. There has been no final decision, and the topic will most likely be reviewed when Russian Foreign Minister Sergei Lavrov arrives in India on Thursday for a two-day visit.

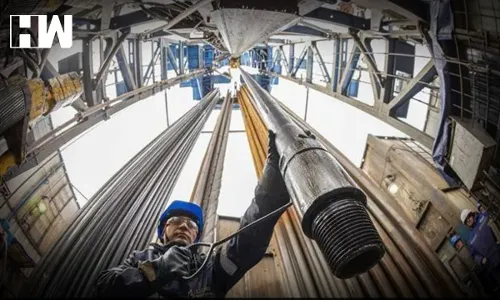

The direct purchase is expected to include Russia’s Rosneft PJSC and India’s largest processor Indian Oil Corp., which have an optional term contract for close to 15 million barrels per year that is rarely used. It’s unclear what the high end of the buying range will be, but India’s desire for the grades on offer is likely to be limited.

Shares of Indian state-run refiners rose in Mumbai. Indian Oil climbed 2.3% as of 10:53 a.m., while Hindustan Petroleum rose 2.4%, beating the 0.1% gain in the benchmark index.

The two sides are exploring routing the oil through Russia’s Vladivostok Port in the far east to avoid shipping hurdles from the Baltic Sea in the west of the country. From there, oil shipments could reach India’s east coast refineries in fewer than 20 days, they said.

India is also seeking to push for greater exports of medicines, engineering goods and chemicals to Russia to narrow its trade gap created by oil and arms purchases.

Since the start of the war, Urals crude has been selling at a discount. In a pricing window organised by S&P Global Platts last week, Litasco, the trading arm of Russia’s Lukoil PJSC, offered a cargo of Urals at a discount of $31.35 to the Dated Brent benchmark. There were no bids, and the price was lower than a record-low offer made by Glencore Plc just over a week ago. China purchases a different grade of Russian oil.

While the United States and its allies have attempted to isolate and punish Russia for its invasion of its neighbour, India has taken a milder posture. Despite international pressure, India has not issued a strong condemnation of Moscow’s action.

New Delhi’s attempts to circumvent the SWIFT system in order to buy cheap Russian oil have been chastised by its Quad allies, which comprise the United States, Australia, and Japan. Other countries, such as the United Kingdom, have exerted pressure on India.

Russia is the “number one” threat to world order, according to visiting UK Foreign Secretary Elizabeth Truss. She also urged for tougher sanctions against Russian banks during an event with her Indian counterpart Subrahmanyam Jaishankar.

Mr. Jaishankar was enraged by what he described as a “coordinated assault” against India’s purchase of Russian oil.

He stated, “India is not among the top ten purchasers of Russian oil.”

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.