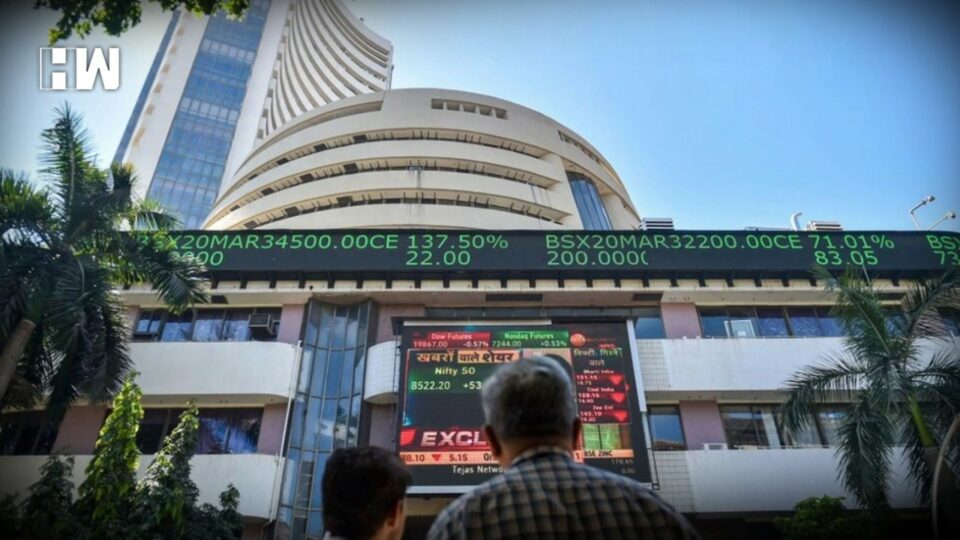

New Delhi: Indian stock indices traded largely steady on Wednesday morning and continued to stay at their all-time highs for the third straight day.

At 9.49 am, Sensex traded at 62,678.90 points, down just 2.94 points or 0.0047 per cent, while Nifty traded at 18,629.95 points, up just 11.90 points or 0.064 per cent. The robust inflows of foreign funds, the relative strength of the Rupee, and the hint by the US Fed on slowing down on policy rates have been keeping Indian stock markets buoyant.

The minutes of the US Federal Reserve’s latest monetary policy review meeting showed a substantial majority of members judged that a slowing in the pace of increase in policy rates would likely “soon be appropriate”.

Coming to foreign funds, they purchased almost Rs 35,000 crore worth of equities in India in November, NSDL data showed.

Also Read: RBI to launch retail digital rupee on Thursday on pilot basis

Among the Nifty 50 companies, Hindalco, JSW Steel, Tata Steel, Dr Reddy’s, and Bajaj Auto are the top gainers, whereas HCL Tech, Infosys, Tech Mahindra, BPCL, and Apollo Hospitals are the top losers, National Stock Exchange data showed.

“An important feature of the ongoing rally which has taken the Sensex and Nifty to record highs is that this is a mature rally led by high-quality stocks in performing sectors. There is no celebration in the market because this rally has largely bypassed the broad market,” said VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

Vijayakumar added profit booking and selling by domestic institutional investors at higher levels can trigger corrections.

Further, Rupee opened at 81.64 versus the previous session’s closing of 81.72. For the record, in October, the rupee breached the 83 mark for the first time in its history.

(Except for the headline, this story has not been edited by HW News staff and is published from a syndicated feed.)

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.