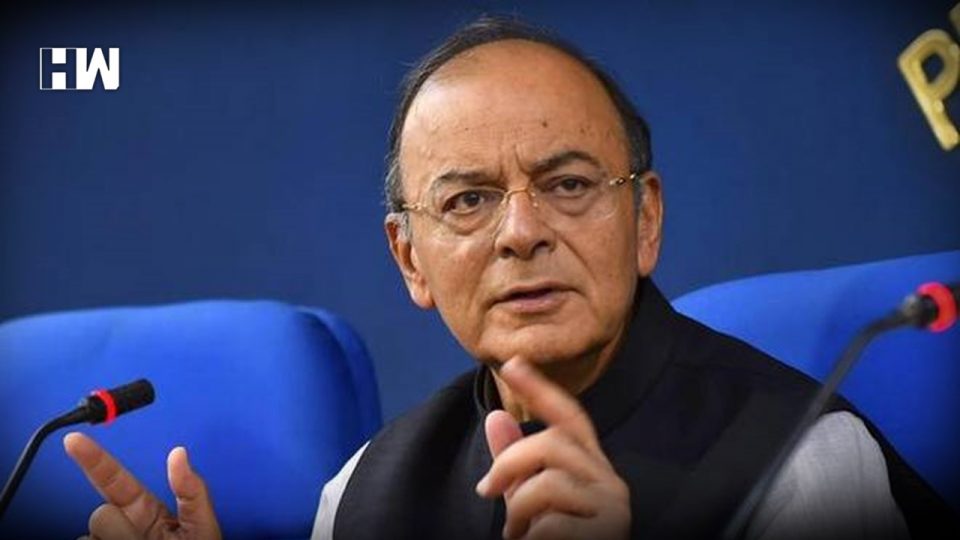

New Delhi | Finance Minister Arun Jaitley said Rs 80,000 crore has been recovered by creditors in 66 cases resolved by NCLT and around Rs 70,000 crore more is likely to be realised by March-end.

Accusing the Congress of leaving behind a legacy of an “anachronic system” of resolving commercial insolvency, Jaitley said the NDA government acted swiftly to recover the non-performing loans and legislated the insolvency and bankruptcy code (IBC).

He said National Company Law Tribunal (NCLT) had started receiving corporate insolvency cases by the end of 2016 and so far 1,322 cases have been admitted by it. A total of 4,452 cases have been disposed at pre-admission stage and 66 have been resolved after adjudication. 260 cases have been ordered for liquidation.

“In 66 resolution cases, the realisation by creditors was around Rs 80,000 crore… Some of the big 12 cases such as Bhushan Power and Steel and Essar Steel India are in advanced stages of resolution and are likely to be resolved in this financial year in which realisation is expected to be around Rs 70,000 crore,” Jaitley said.

In a Facebook post titled ‘Two years of Insolvency and Bankruptcy Code’, Jaitley said NCLT has become a trusted forum of high credibility.

“Those who drive the companies to insolvency, exit from management. The selection of new management has been an honest and transparent process. There has been no political or governmental interference in the cases,” he added.

As per NCLT database, in 4,452 cases disposed at pre-admission stage, the amount apparently settled was around Rs 2.02 lakh crore, the minister added.

Jaitley said the increase in conversion of NPAs into standard accounts and decline in new accounts falling in NPA category show a definite improvement in the lending and borrowing behaviour.

“The early harvest through the IBC process has been extremely satisfactory. It has changed the debtor-creditor relationship. The creditor no longer chases the debtor. In fact, it is otherwise,” the minister said.

Jaitley said the Congress government had enacted the Sick Industrial Companies Act (SICA) during 1980s for rehabilitation of sick companies. This applied to companies whose net worth had become negative.

“The law proved to be an utter failure. Law carried out rehabilitation, several sick companies got a protective iron curtain against creditors,” he said.

Besides, the Debt Recovery Tribunal was created to enable banks to recover every due diligently, but these have not proved to be a highly efficient mechanism for recovering debt, he added.

“For non-corporate insolvencies the Provincial Insolvency Act was applicable. This was a rusted piece of legislation, ineffective and had faded away because of disuse,” Jaitley added.

He said, between 2008 and 2014, banks lent indiscriminately and this lead to a very high percentage of NPAs which was highlighted by the Asset Quality Reviews of the RBI.

“This led to a prompt action by the government… The IBC was approved by both Houses of Parliament in May, 2016. This was the quickest economic legislative change that I have seen being made by Parliament,” Jaitley said. PTI

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.