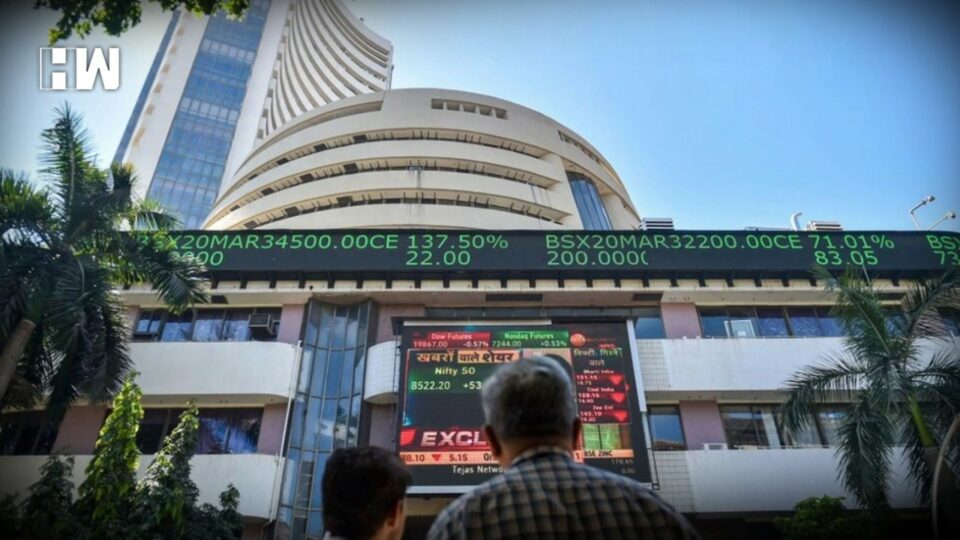

New Delhi: Indian stock indices traded higher during Tuesday’s session and remained in the green for the second straight day of the week.

The benchmark stock indices – Sensex and Nifty – had witnessed losses for four days last week. Sensex closed at 60,927.43 points, up 361.01 points or 0.60 per cent, whereas Nifty closed at 18,132.30 points, up 117.70 points or 0.65 per cent.

Among the Nifty 50 stocks, Hindalco, Tata Steel, JSW Steel, Tata Motors, and ONGC were the top five gainers, while Hindustan Unilever, Apollo Hospitals, Nestle India, Mahindra and Mahindra, and ITC were the top five losers, National Stock Exchange data showed.

“Equities globally climbed Tuesday amid positive sentiment from China’s rollback of Covid isolation measures (raising hopes of a recovery in the world’s second-largest economy) and the cooling of a key inflation gauge in the US,” said Deepak Jasani, Head of Retail Research, HDFC Securities.

Meanwhile, Rupee closed at 82.85 against the US Dollar versus Monday’s closing of 82.65.

Also Read: UP Urban Local Body Polls Will Be Conducted Without OBC Reservation Orders HC

According to Dilip Parmar, Research Analyst at HDFC Securities: “Month-end dollar demand from oil importers and year-end rebalancing foreign fund outflows weighed on the Indian rupee in today’s trade as it surrendered Monday’s gain. The surge in crude and precious metal prices also weighed on the local unit.”

Parmar added the rupee is expected to trade between 82.40 to 82.90 against the US Dollar in the near term and outlook remains weak as long as it trades below 82.40.

(Except for the headline, this story has not been edited by HW News staff and is published from a syndicated feed.)

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.