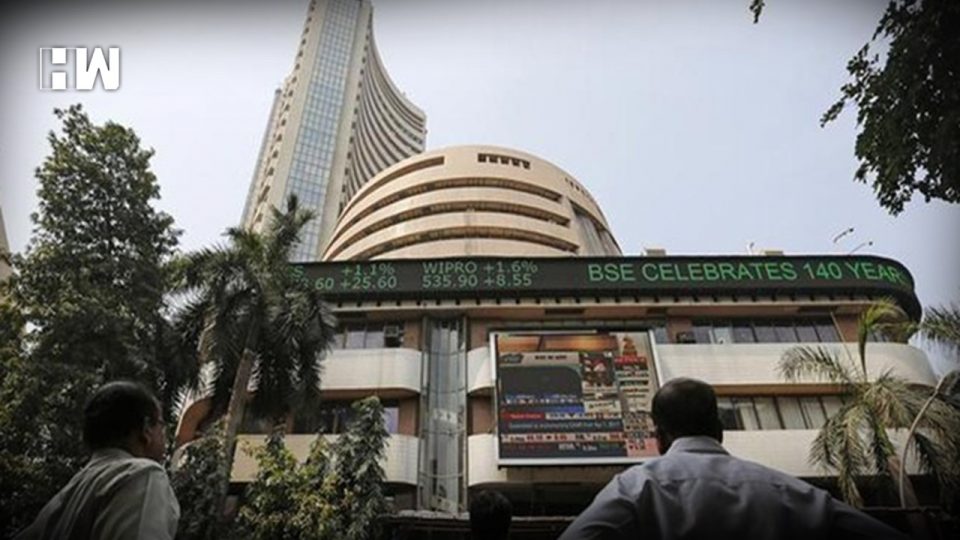

Mumbai | The benchmark BSE Sensex jumped over 200 points and the NSE Nifty reclaimed the 11,500 mark in early trade Wednesday led by gains in banking stocks amid sustained foreign fund inflows and positive global cues.

The 30-share index was trading 205.47 points, or 0.54 percent, higher at 38,438.88. It had ended 424.50 points, or 1.12 percent, higher in the previous session. The broader Nifty also rose 53.45 points, or 0.47 percent, to 11,536.70 in morning trade.

Top gainers include IndusInd Bank, SBI, Sun Pharma, Bharti Airtel, L&T, Bajaj Finance, Axis Bank and Tata Motors, rising up to 3.62 percent. While, ONGC, NTPC, PowerGrid, Hero MotoCorp, Coal India, ICICI Bank and RIL were among the top laggards, shedding up to 1.10 percent.

Sector-wise, BSE Capital Goods index was the biggest gainer, rising 0.70 percent, followed by BSE Bankex, finance, FMCG, healthcare and auto indices gaining up to 0.54 percent.

“Indian markets have been the recipient of robust foreign flows this entire March on the back of increased likelihood of strong political stability and policy continuity post elections and the softer stance adopted by global central banks,” said Devang Mehta, Head Equity Advisory, Centrum Wealth Management.

Foreign portfolio investors (FPIs) bought shares worth a net of Rs 999.02 crore Tuesday, while domestic institutional investors (DIIs) sold shares worth Rs 196.70 crore, provisional data showed.

In the Asian region, Hong Kong’s Hang Seng was up 0.49 percent, Korea’s Kospi was trading marginally higher, Shanghai Composite Index gained 0.55 per cent; while Japan’s Nikkei fell 0.61 percent.

On Wall Street, the US Dow Jones Industrial Average ended 0.55 percent higher on Tuesday. The rupee, meanwhile, depreciated 5 paise against its previous close to 68.91 against the US dollar in early session.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.