The fact is that the economy is in a disturbing slowdown mode, which the government has been doctoring with window dressed statistics of growth and employment.

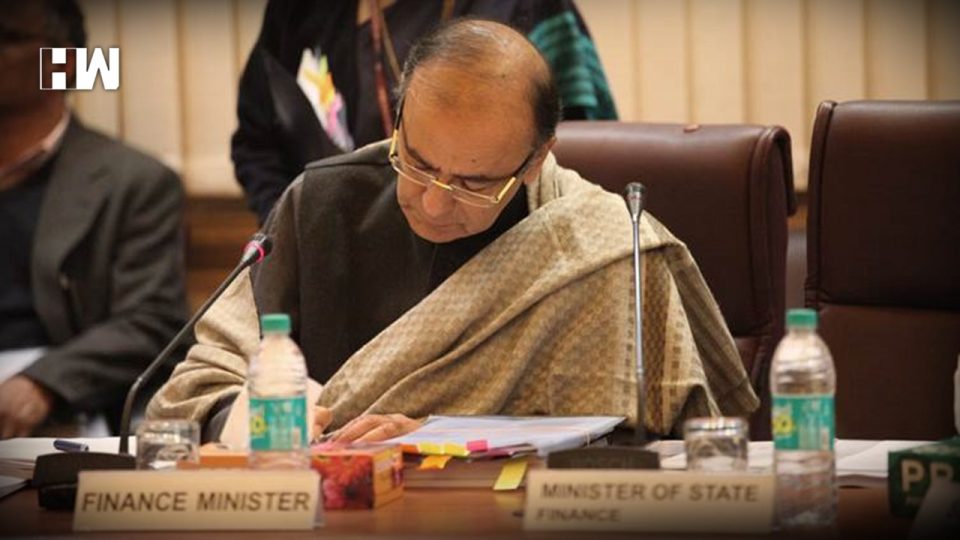

After the pruning of India’s estimated GDP growth rate for the FY 2019 and for the next two years, by the World Bank, the IMF and the ADB etc., comes the news that the Ministry of Finance, in its monthly report on the Indian economy for March 2019, released by the DEA, has admitted that the Indian economy appears to have slowed down in FY 2018-19. In line with the government’s regrettable inclination to not accept unfavourable developments by doctoring statistics, the MoF does not really candidly and wholeheartedly concede a slowdown in the economy, but plays it down by saying that it appears to have slowed down. That is a half-hearted admission of a stark reality, which has been visible on the ground for many months. Ask any entrepreneur about the economic slowdown that the government now admits and he will say with pained sarcasm, ‘so what’s new’. And that slowdown reflects not just in the sales and income of small entrepreneurs, but also on those of giants like Hindustan Unilever Ltd.

The estimate as per emerging trends now is that as against estimated GDP growth of 7.3%, the Indian economy grew by 6.98% during the FY 2018-19, with an unmistakable and sharp slowdown in the last two-quarters of the FY. As per this report of the MoF, the reduction in India’s growth is due to the declining private consumption, tepid increase in fixed investments, muted exports and a slowdown in growth in the agri sector. It is also due to a lack of sustained growth in our industrial production.

To us, whether the government admits of a slowdown in the economy or not, its signs have been visible all around, since quite some time. Corporate profits which reflect an aggregate state of the economy have been receding, income tax collections fell short of the target by an alarming 11%, and so did GST collections fall short of target by Rs.1 lakh crores, industrial growth in February 2019, at 0.1% is at its slowest in 20 months, sales of automobiles including two-wheelers are down, Maruti Udyog is said to have reported a five year low in car sales, the Reserve Bank reports an Rs.1 lakh crore shortfall in bank credit in April 2019, consumption of petro goods recorded its lowest growth in seven quarters, finished steel production is at its second lowest in five years, the banking and NBFC crisis remain unresolved and the EPFO data shows a 26% fall in average monthly job creation. There is such a clear lack of confidence in the economy that corporates are sitting on a record bank balance of over Rs.6.50 lakh crores, unwilling to invest and risk it in new projects.

The fact is that the economy is in a disturbing slowdown mode, which the government has been doctoring with window dressed statistics of growth and employment. All the four engines of growth have stalled and the economy’s momentum is receding. While the nervous private sector, loaded with opposites of NPAs and cash, is unwilling to commit investment in new projects, which has slowed down to a 15 year low, the government which is battling fiscal deficit and slowing revenues, aggravated by populist political spending now has depleted resources to kickstart the economy through public sector spending. As a result of unemployment and falling household incomes, consumer spending has also fallen, and our exports, never a dependable economic locomotive are any way suffering in a world economy fraught with trade wars.

It is not that the economic growth of India has suddenly receded. We could see the train arriving in the last few months, but the government has preferred to be in a denial mode, thus refusing to recognise the problem, due to which no policy measures were initiated to prevent/combat this economic slowdown. It has to do with a lack of any vision and strategy to manage the economy. While the economy has taken a backseat in the face of a fiercely fought elections, it will have to occupy the front seat, as soon as a new government takes charge. And the onus will be on the new government to revive the economy and kickstart growth, for which the only way out will be huge government spending, like a quantitative easing that the American government resorted to in the aftermath of the 2008 economic meltdown in the USA. But with a depleted treasury that means aggravating our fiscal deficit, inflation and current account deficit.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.