Despite the conflicting and contradictory statements about the state of affairs of NHAI emanating from the PMO, the concerned minister and its former top officials, one thing is clear that NHAI’s state of affairs are precarious and are a matter of concern.

If NHAI were a private sector entity, it would perhaps have been classified as a NPA account by its lenders, or its loans would be undergoing restructuring.

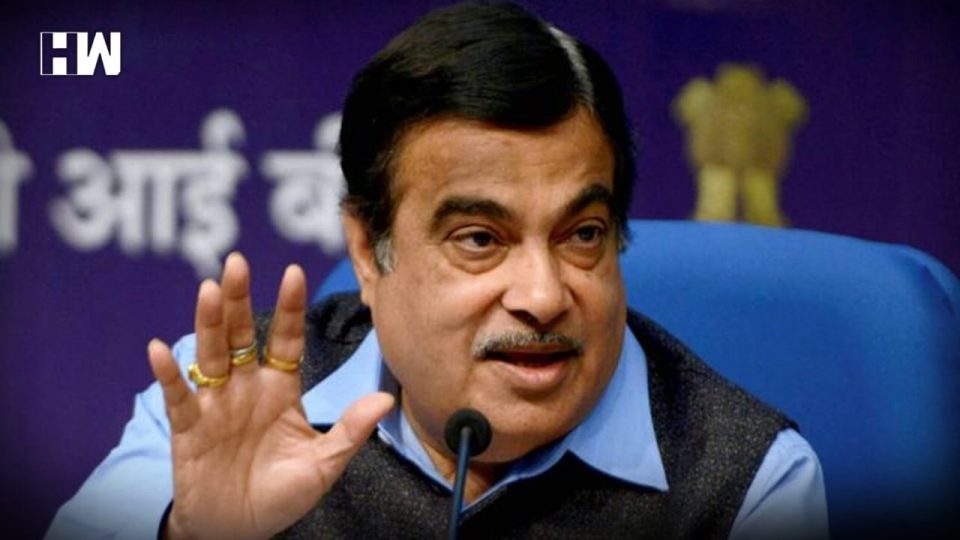

Mr. Nitin Gadkari says that NHAI will be restructured and that it is working with banks and other lenders, including World Bank and Japanese agencies like JICA and JBIC, to raise funds for greenfield road projects. He expects the NHAI to raise Rs.85000 crores by 2025 and says that after the completion of the Bharatmala Pariyojana projects, it will need lesser funds and will focus on asset management, asset monetisation, maintenance and augmentation of road etc.

The budding crisis in NHAI, which is primarily engaged in the activity of road construction and financing, has interesting parallels with the crisis ridden ILFS, which also has been engaged in the construction and financing of infrastructure, though not just in roads and highways only like the NHAI, but into power, water utilities etc.

And when we draw these parallels, there are also important lessons for the NHAI and India’s infra sector from this comparison.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.