So the Jeffries head Christopher Wood is not wrong when he says that the Indian economy has been a victim of Modi government’s shock therapies

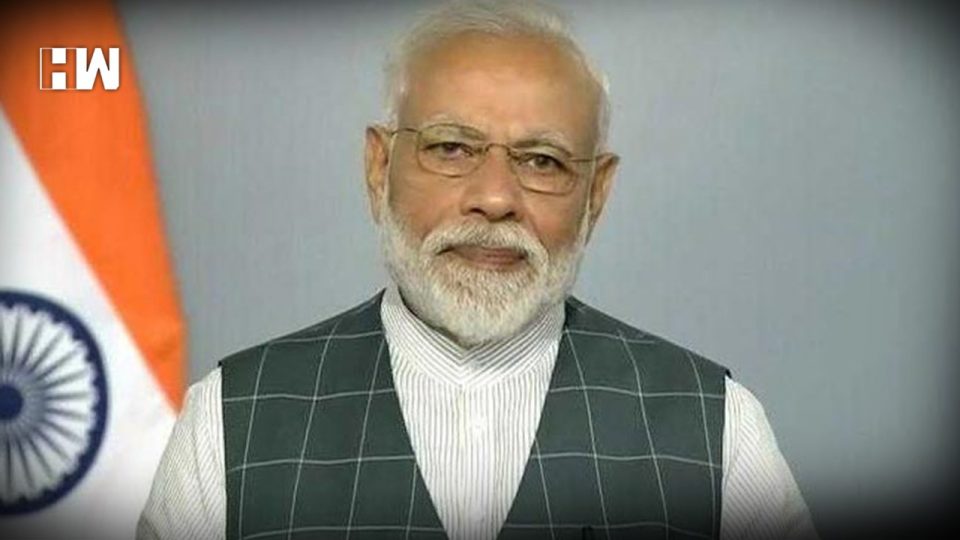

Mumbai: In his weekly note to investors, Christopher Wood the global head of equity strategy at Jeffries says that the Indian economy is a victim of the Narendra Modi government’s shock therapy since it assumed power in 2014 and that it could take four more quarters before the economy recovers. He refers to reforms like demonetization, GST, RERA, and IBC, which have shocked the economy, though they will all prove to be positive in the long run. He says that there is no doubt that the initial shock impact of these reforms on the economy was underestimated by the BJP government. He says that the Indian economy and its entrepreneurs are experiencing the withdrawal symptoms of cold turkey, faced by a drug addict. He says that the economy continues to be impacted by the ripple effects of the funding squeeze in the NBFC and housing finance companies. These shock effects have been felt the most in small and mid-cap companies. To mitigate the effects of these shocks, he expects the government to continue announcing measures to prop up the economy, mindful of the rising fiscal deficit.

There is no doubt that these measures ie. demonetization, GST, IBC, and RERA were absolute shockers in themselves. Demonetisation Overnite nullified and sucked out 87% of the currency in circulation and with remonetization taking months to be implemented, it deprived the businesses, particularly those in the informal, unorganized and small sectors of their business income and cashflows, it deprived workers of their livelihood as lakhs were rendered jobless on the closure of enterprises and many, particularly those in the rural belts lost their hard-earned savings, due to their failure to deposit cash in the bank accounts. With the combined effects of delayed remonetization, rising unemployment, and business closures, the ordinary consumer was reluctant to resume his spending habits in a cashless manner, much as the government thought that he would. The hurried GST too was disruptive in its own way. Its complications forced the small entrepreneur to be out of business rather than face the rigors of the law, that they could understand little. Moreover, those who chose to be under the GST regime, realized that they now needed a much higher working capital investment, under the new GST billing and payment cycle, which they could not infuse thus leading to the shrinking of their businesses. To make matters worse for these sectors, many big entities were simply reluctant to trade with those small entities which chose to be out of the ambit of GST, thus leading to the decimation of their businesses and income too, GST too thus hampered business cashflows and the resultant earnings.

IBC was meant to sort out the chaos and crisis of NPAs in the banking system, which was stranded under the load of unresolved NPAs. But then like any resolution under court proceedings, which just cannot take place in a time-bound manner, so was the fate of the NPA cases filed before the NCLT. The system is rife with delays and uncertainty, best symbolized by the Essar Steel case. As far as resolving bank NPAs is concerned, IBC has proved to be a virtual non-starter, such that banks prefer to settle NPA accounts out of the IBC, rather than face the never-ending delays/uncertainties of the NCLT. The introduction of RERA was bound to shake up the real estate industry for good. But it was put in place at a time when the real estate industry was already facing a slump. The timing of this shock therapy should have coincided with the real estate industry being in a much healthier state, and not when it was on the verge of collapsing.

So the Jeffries head Christopher Wood is not wrong when he says that the Indian economy has been a victim of Modi government’s shock therapies. He is not exaggerating when one looks at the effect of these measures on sectors of the economy, across the board. The small ones suffered the most and perished at times, while the big ones with resources struggled to survive. These shock measures, though largely well-intentioned, were certainly introduced without adequate thinking, planning, and preparation and came in such quick succession, such that instead of being a cure they became a curse. They were simply introduced without bothering to check whether the economy was able to withstand and absorb them or not. They will prove to be positive in the long run, but they have come at a huge cost, which was certainly avoidable. What was needed was a clear analysis of the chaos that would ensure due to these measures and their introduction then in a gradual, planned an all-inclusive manner, which was unfortunately not done.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.