“A new journey is starting today. Honouring the Honest. The honest taxpayers of the country play a big role in nation-building,” PM Modi said.

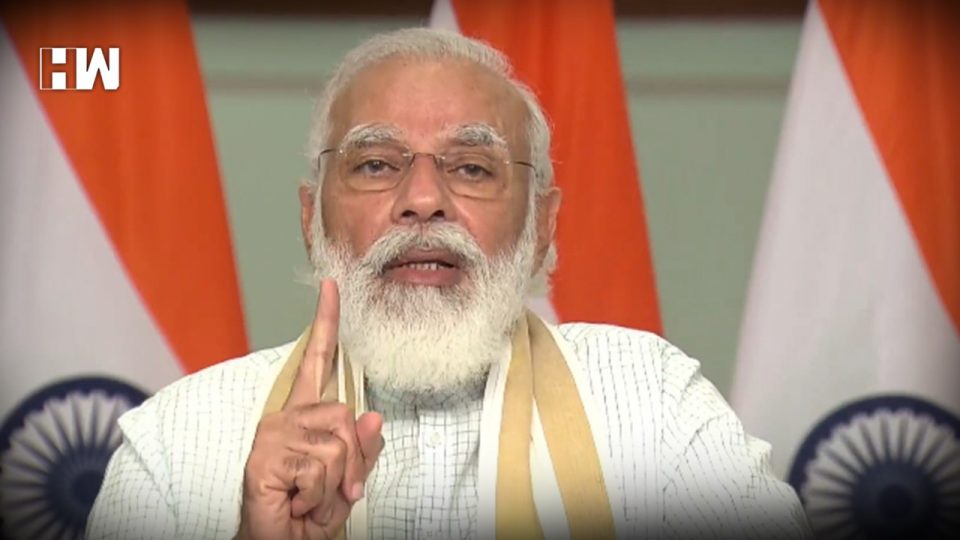

New Delhi | Prime Minister Narendra Modi on Thursday launched a new platform for the country’s honest taxpayers, ‘Transparent Taxation – Honoring the Honest’. This includes major reforms such as faceless assessment, appeals and taxpayer charters, etc. Modi said that Faceless Assessment and Taxpayer Charter have been implemented from today. The faceless appeal will be implemented across the country from 25th September i.e. Deendayal Upadhyay’s birthday.

Finance Minister Nirmala Sitharaman had announced to bring Taxpayers Charter in the last budget. Last week, she had also hinted at early implementation of the charter. The Ministry said that the CBDT has taken several steps to bring transparency in the functioning of the Income Tax Department. Here are the highlights from PM Modi’s speech:

Honoring the Honest- ईमानदार का सम्मान।

देश का ईमानदार टैक्सपेयर राष्ट्रनिर्माण में बहुत बड़ी भूमिका निभाता है।

जब देश के ईमानदार टैक्सपेयर का जीवन आसान बनता है, वो आगे बढ़ता है, तो देश का भी विकास होता है, देश भी आगे बढ़ता है: PM @narendramodi #HonoringTheHonest

— PMO India (@PMOIndia) August 13, 2020

Big role of honest taxpayers in nation-building

PM Modi began his speech by congratulating the taxpayers, officers and employees of the Income Tax Department. He said that over the past 6 years, his govt focused on ‘Banking the Unbank’, ‘Securing the Unsecured’ and ‘Funding the Unfunded’. “A new journey is starting today. Honouring the Honest. The honest taxpayer of the country plays a big role in nation-building. If he moves forward, the country also moves forward,” PM Modi said.

Emphasis on making the policy people-centric

The prime minister said that the new facilities starting from today are also a big step towards reducing the government’s interference in the lives of the citizens. He said that his govt is trying to put more emphasis on making every rule of law, every policy from process and power-centric to people-centric and public-friendly. “The country is also getting satisfactory results. Today everyone has realized that short cut is not right,” he said.

जहां Complexity होती है, वहां Compliance भी मुश्किल होता है।

कम से कम कानून हो, जो कानून हो वो बहुत स्पष्ट हो तो टैक्सपेयर भी खुश रहता है और देश भी।

बीते कुछ समय से यही काम किया जा रहा है।

अब जैसे, दर्जनों taxes की जगह GST आ गया: PM @narendramodi #HonoringTheHonest

— PMO India (@PMOIndia) August 13, 2020

Four reasons for change

PM Modi explained four reasons for the change. First- Policy-Driven Governance. This minimizes the grey area. Second – Belief in the sincerity of the general public. Third, the use of technology by reducing the human interface in government systems. Fourth- The qualities of efficiency, integrity, sensitivity are being rewarded in the government machinery.

Over 1500 laws abolished

PM Modi said that there was a time when decisions taken under pressure were also called reforms. “Now, this thinking and approach have changed. For us, reform means that this policy should be based, not fragmented and one reform should be the basis of another reform. The process should also not stop after one reform. More than 1,500 laws have been abolished in the past few years. India ranked at 134th in Ease of Doing Business index a few years ago, now it is on 63rd,” PM Modi said.

अब टैक्सपेयर को उचित, विनम्र और तर्कसंगत व्यवहार का भरोसा दिया गया है। यानि आयकर विभाग को अब टैक्सपेयर की Dignity का, संवेदनशीलता के साथ ध्यान रखना होगा।

अब टैक्सपेयर की बात पर विश्वास करना होगा, डिपार्टमेंट उसको बिना किसी आधार के ही शक की नज़र से नहीं देख सकता: PM @narendramodi

— PMO India (@PMOIndia) August 13, 2020

Increased confidence of foreign investors

PM Modi said that reforms brought by his government have also boosted the confidence of foreign investors. He said the arrival of record FDI in India even in the Corona period is an example of this.

Hitting at UPA govt, PM Modi said that earlier a lot of people had to go through an unnecessary hassle to identify a handful of people. “There should have been an increase in the number of taxpayers, but the alliance system crushed the aspirations of an honest businessman, youth power. Where there is complexity, compliance is also very low,” Modi said.

Easy to arrange refunds from returns

Stressing on GST, he said that the arrangements from returns to refunds have been simplified. The government first used to approach the High Court and the Supreme Court in disputes above 10 lakh. Now the limit of cases is up to Rs 1 crore in the High Court and up to Rs 2 crore in the Supreme Court. About 3 lakh cases have been resolved in a short time. Tax on income of Rs 5 lakh is now zero.

PM Modi said The number of people filing tax returns has increased, but much less in a population of 130 crores. Out of all the return files filed in 2012-13, 0.94% were scrutinized. In 2018-19, it has come down to 0.26%, i.e. it has decreased four times. The number of return filers has increased by about 2.5 crores in the last 6-7 years. He said, however, there is no denying that this is very low in a country of 130 crore people.

What is Taxpayers Charter?

The purpose of the Taxpayers Charter is to increase trust between taxpayers and the Income Tax Department, reduce the hassle of taxpayers and determine the accountability of officers. At present, it is applicable only in three countries of the world- USA, Canada and Australia. The Taxpayers Charter of these three countries includes 3 key points-

1. Assuming the taxpayer, to be honest

Respect them as honest taxpayers until it is proven that the taxpayer has committed tax evasion or misconduct.

2. Timely service

Resolving taxpayers’ problems quickly. If an immediate solution to a problem is not possible then arrange the solution in the fixed timeline.

3. Scrutiny before order

Giving taxpayers a chance to scrutinize before issuing an order against them, so that the wrong order is not passed.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.