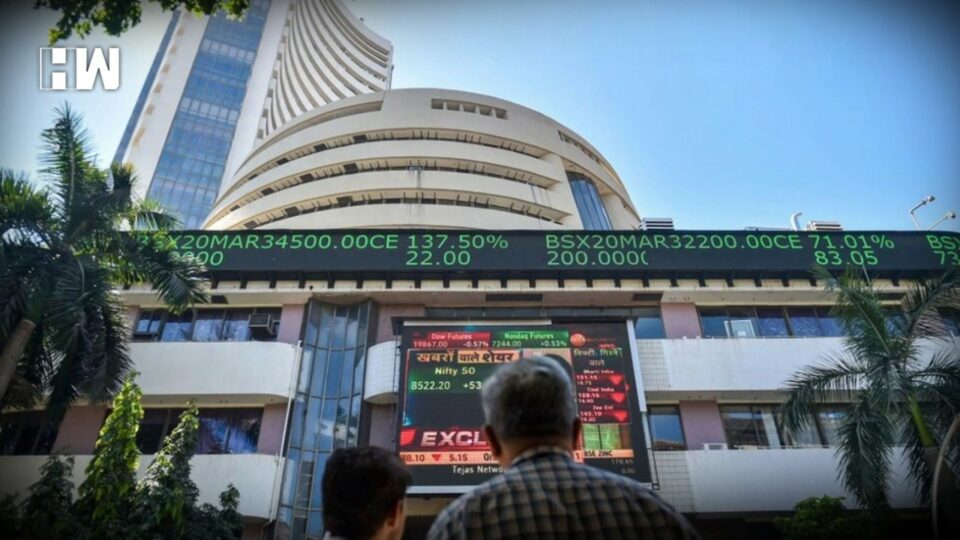

Indices of Indian markets fell on Tuesday after gaining for seven consecutive days as BSE Sensex dipped 287.70 points to 59,543.96 while Nifty50 went down by 74 points to settle at 17,656 level.

The stocks on Indian bourses rallied in the morning trade and declined after that, picking up cues from volatile Chinese markets which reeled under the anticipation that Chinese President Xi Jinping’s new leadership team might prioritise the state at the expense of the private sector. The most active stocks on the 30-share sensitive index were South Bank, Bank of India, MCX, J&K Bank and BHEL which moved 10.79 per cent, 10.15 per cent, 9.10 per cent, 7.35 per cent and 7.32 per cent respectively.

BSE MidCap went up by 111.02 points to 25,040.86 levels with IGL, IOB, Torrent Power, Bharat Forge Max Health, Canara Bank as some of the most active stocks while BSE LargeCap dipped 26.49 points to 6,858.17 with PNB Bank, Zomato, Tech Mahindra and Maruti as some of the active stocks.

Some of the most active stocks in Nifty were Eicher Motors and Larsen & Toubro while Britannia, Kotak Bank and Nestle India were laggards.

Stock indices during the auspicious hour of the Muhurat trading on Diwali eve went up as Sensex surged 562 points to 59,869.22 and Nifty50 rose 157 points to 17,733.40 level on Monday.

The special trading window marks the beginning of Samvat 2079, and buying assets is considered auspicious on this day.

“The initial months of Samvat 2079 are likely to be highly volatile with alternative bouts of selling and buying in the mother market US, which will have repercussions on other markets including India,” said V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

He said investors can approach Samvat 2079 with cautious optimism and remain invested in high-quality stocks and buy on declines in performing sectors like banking, capital goods, telecom and autos. \

(Except for the headline, this story has not been edited by HW News staff and is published from a syndicated feed.)

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.