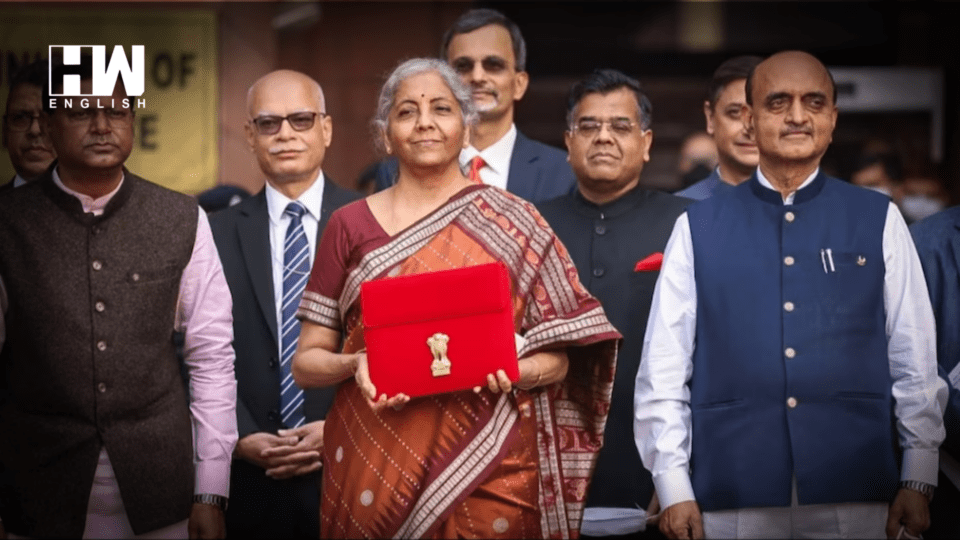

India looks forward to seeing what Finance Minister Nirmala Sitharaman has in mind for the interim budget 2024. There are still a few significant expectations, even though it’s vital to remember that an interim budget’s primary goal is to continue funding necessities until a new administration enters office.

The government presents an interim budget, sometimes called a vote-on-account, as a temporary financial plan when it lacks the time or authority to produce a total budget.

On February 1, 2024, the interim fiscal year 2024–25 budget will be presented. Ordinarily, an interim budget comes before the general elections in India, which are scheduled for April and May of 2024.

Significant policy changes are unlikely because the policy is temporary. However, there are strong expectations in various sectors:

1. Taxpayers who receive salaries: Higher income tax slabs or deductions to encourage spending by consumers.

2. Farmers: PM Kisan payouts should be maintained or increased to promote rural income.

3. Infrastructure: Encourage infrastructure development, especially in roads, trains, and semi-urban areas.

4. Education and healthcare: To improve social welfare, more funding should be allocated to education and healthcare.

5.MSMEs: Initiatives to support small and medium-sized businesses to promote entrepreneurship.

6. Digital economy: Measures to stimulate the sector’s expansion through incentives and policies.

7. Green energy: Promote the development of renewable energy infrastructure and clean energy resources.

8. Employment generation: Initiatives to support local manufacturers and increase skill levels for employment creation.

9. Controlling inflation: Preserving price stability by judicious use of funds and focused measures.

10. Social welfare: Ongoing assistance to women, seniors, and farmers, among other disadvantaged populations.

Not to expect:

Radical reforms: Due to its temporary character, the interim budget is unlikely to implement significant structural or policy changes. These usually necessitate thorough organisation and execution, which is impossible in the allotted time.

Populist programmes: While some adjustments to current programmes might be made, extensive welfare programmes or populist campaigns meant to win over people are doubtful. The administration would not want to jeopardise long-term fiscal restraint for quick political benefits.

Major tax overhauls: Income tax slabs, deductions, and exemptions are unlikely to undergo significant modifications. While it is feasible for the government to make little modifications or rationalisations, major overhauls before the complete budget are probably out of the question.

Excessive spending: Because of its bridging role, the interim budget prioritises paying for ongoing obligations and preserving vital services. It seems unlikely that expenses would rise significantly over what is required to keep things running smoothly.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.