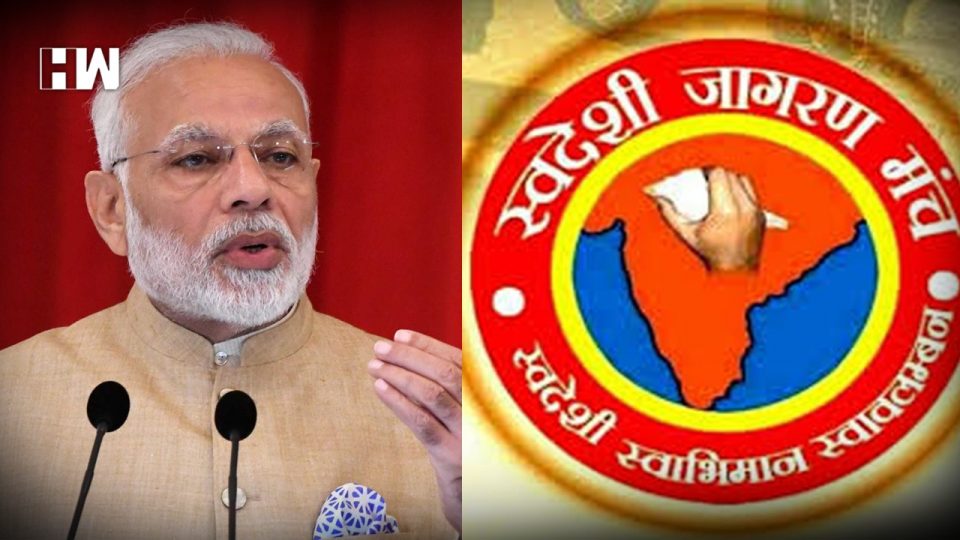

New Delhi | The economic wing of RSS, Swadeshi Jagran Manch has questioned the Narendra Modi led Union Government over its plan to raise money by selling foreign currency bonds.

Terming the move as ”Anti-patriotic” and the RSS economic wing has asked the government to review its plan as it could create long term risk for the country. According to News agency Reuters, the Swadeshi Jagran Manch has opposed the move as it could create long-term risks for the economy, potentially allowing rich foreign nations and their financial institutions to dictate the country’s policies.

Ashwani Mahajan, the co-convenor of Swadeshi Jagran Manch (SJM) said that the organisation will campaign against the plan by convening meetings of influential economists. Mahajan, as quoted by Reuters, said, “We are confident that government will withdraw its decision on these bonds.”

Citing the examples of several countries like Argentina and Turkey Mahajan said,” We must look at the experience of countries that have taken loans from international markets to meet their government deficit. The experience of these countries has been far from good,” He also worried that going overseas to borrow may mean that the rupee currency depreciates at a faster rate and allows foreign governments to demand tariff reductions.

Earlier Finance Secretary Subhash Chandra Garg speaking on the Overseas debt move said that the plan was part of the efforts to help the economy grow faster by bringing down the real interest rates for Indian firms. He also clarified over choosing overseas debt over domestic debt as relying so much on domestic debt was that the government tapped into nearly 80% of total savings in the economy, leaving little for private companies. Relying on the domestic debt cause the businesses to pay up to 12-13% as interest rates on bank loans.

Former Finance Minister Arun Jaitley on February 2018 in his paper on public debt wrote, “Most of the debt is of domestic origin, insulating the debt portfolio from currency risk.”

Raghuram Rajan, Former Reserve Bank of India governor has also raised his concern over Union Government’s plan of Overseas debt. Rajan in his 13th July article in Times Of India asked the government,” Could the resulting volatility in India’s debt traded on foreign exchanges then transmit to our domestic G-Sec market? Would the foreign tail wag the domestic dog?”

The report also quoted BJP Spokesperson on Economic Affairs Gopal Krishna Agarwal who claims that the despite some risks, the sovereign bonds are the “best alternative” at this point considering the Narendra Modi government’s massive investment plans. He said, “The government’s goal of keeping real interest rates low makes it difficult to raise funds in the domestic market at reasonable rates. However, he advised that the government has to stick to its fiscal deficit target of 3.3% of GDP for the current year ending next March and ensure that overseas borrowing does not lead to a higher deficit.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.