The Enforcement Directorate continues to probe the malpractices and criminal misconduct of Ms. Chanda Kochhar, when she was the CEO of ICICI Bank. In focus is the receipt of quid pro quo, or bribes of Rs.64 crores received by her husband’s company Nu Power Renewables, from the Videocon group, for loans of over Rs.3000 crores, which were sanctioned on six different occasions to it by ICICI Bank and which have turned bad. The ED probe has been further extended to the investment of almost Rs.350 crores, that was additionally received by Deepak Kochhar’s Company, from the Matix Group, an offshoot of the Essar group, round tripped through its overseas entities, as consideration for loans given by ICICI Bank, which too have turned bad.

The interim findings of the ED now reveal that the Kochhars got at least Rs.500 crores by way of kickbacks, in consideration of loans sanctioned. Interestingly the probe started with allegations of receipt of kickbacks of Rs.64 crores from Videocon, which have already ballooned to Rs.500 crores and are yet to reach a full stop. The ED says that there is clear evidence of quid pro quo in the loans sanctioned by ICICI Bank during Chanda Kochhar’s tenure as its CEO and it is very likely that Videocon and Essar are not the only cases where such illegal gratification was received and that there could be many more such cases, lurking in this murky state of affairs. The huge assets of the Kochhar family, which were created out of these proceeds of crime, are bound to be seized by the ED, whose investigation is yet to reach any finality.

These disturbing findings reveal that under Chanda Kochhar’s leadership, there was a prevailing practice in ICICI Bank of receiving illegal kickbacks against loans sanctioned. It was certainly a blatant one and very evident because in the case of Videocon, loans were sanctioned on six different occasions between June 2009 to October 2011, that too when the earlier loans had turned bad. No wonder the enquiry by Justice B N Srikrishna and others reveals that loans were sanctioned, not just in violation of the Reserve Bank regulations, but the internal guidelines of the ICICI Bank too.

The larger and far more serious issue here is not the alleged criminal malpractices of Chanda Kochhar, but that of the failure of the entire board of directors of the bank, including its independent directors, to restrain her from such misconduct. The undisputed fact is that it is not she alone who sanctioned these loans to Videocon, Essar and maybe others that have turned bad, inflicting huge losses to ICICI Bank. They were sanctioned by a credit committee, which consisted of other directors and top executives of ICICI Bank and of which she was just one of the members, obviously an influential one. It is they who collectively sanctioned these loans in violation of the regulations and reports say that none of them put a dissent note or objected to these loans, or any occasion. It is these directors and executives who colluded, diluted institutional checks and balances, violated regulations and let an ambitious and corrupt CEO, take the entire institution for a ride. She apparently ran a mom and pop show of nepotism and corruption, which no one objected to. The responsibility was certainly collective and the CBI is right in having mentioned them in its FIR registered in January 2019. And these include eminent bankers like K V Kamath, Sandeep Bakshi, Zarin Daruwala, Sonjoy Chatterjee and others.

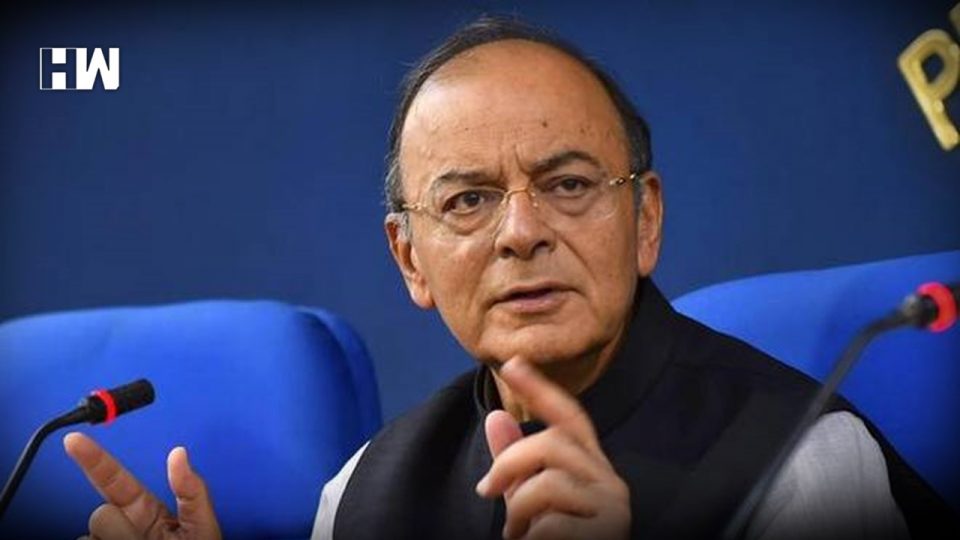

The ED too, like the CBI, is planning to summon these persons to probe their negligence, collusion and suspected participation in the matter. The last time when the CBI proposed to do so, Mr. Arun Jaitley raised a hue and cry, calling it investigative adventurism, which would hurt the interests of the entire banking industry. But then the entire banking industry has suffered due to the collusion and negligence of such persons and who were in charge of the affairs, it is they who need to be probed. Will Mr.Jaitley raise a hue and cry again, like he did the last time, when the CBI registered its FIR, mentioning these persons, colluded/were negligent as members of the ICICI Bank sanctioning committee.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.