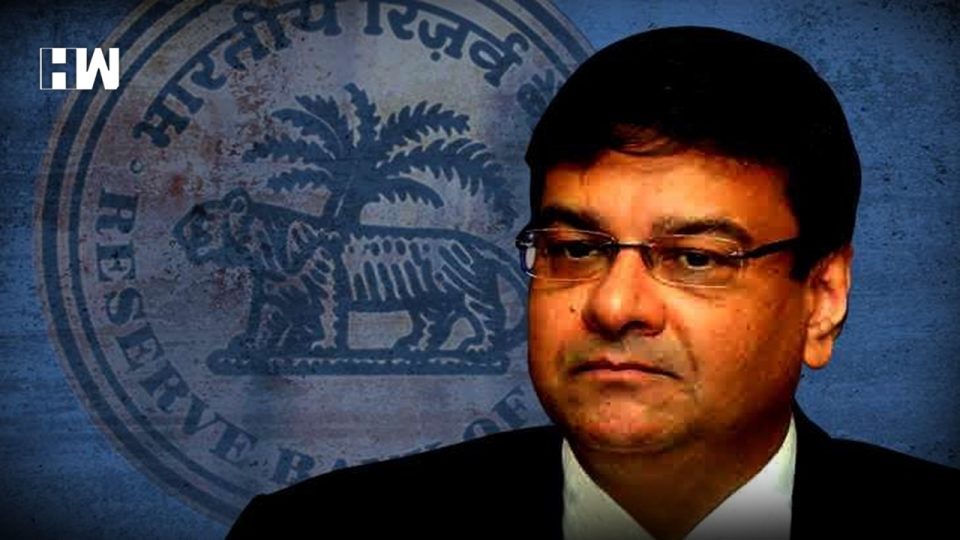

The Central Board that was led by former RBI governor Urjit Patel, which was asked to take into consideration the Centre’s proposal of demonetization, had come for a meeting before the announcement of the note ban on 2nd November 2016. Nonetheless, as per a report by Deccan Herald, Prime Minister Narendra Modi simply got on with the decision before even the central bank approved it.

The government was sent an approval on December 16 which is complete 38 days after currency notes of Rs. 1000 and 500 stopped being legal tender and the Reserve Bank of India had differed with most of the pleas of the government in the favour of the ban.

The RBI, for the first time, has unleashed this in the minutes of meeting of its board held at 5:30 p.m. on 8th November 2016, sought by way of an RTI query, 28 months after the note ban happened which was announced by Modi at 8 p.m. on the same day.

However, the RBI directors showed their disagreed saying, “The growth rate of the economy mentioned is the real rate, while the growth in currency in circulation is nominal and when adjusted for inflation, did not constitute any stark difference”.

As a matter of fact, the RBI had disagreed with the revenue department’s findings as well that the shadow economy for India (where black money transactions do not leave an audit trail) was projected at 20.7% of the GDP in 1999 and had risen to 23.2% in 2007, which was based on World Bank projections.

RTI activist Venkatesh Nayak sought records of all the meetings of the RBI Central Board of Directors along with the presentations, papers or any additional documents that were placed before it. Earlier, the RBI had declined to supply information and cited exemption clause to deny records.

Also the demonetization minutes particularly did not mention the reports of black money submitted by the NIPFP and other two research institutions that were entrusted with the job of calculation of black money.

The RBI directors felt that most of the black money was held in the form of real-sector assets such as gold or real estate and not in cash and therefore demonetization would not make any significant impact on those assets. It had stated that demonetization, on the contrary, would have a negative bearing on the economy in the short term.

Finance Minister Arun Jaitley had lately told Parliament that reports of study on black money could be made available to members of Parliament who sit on the department-related Parliamentary Committee on Finance but would not be floated in the public domain.

However, section 8(1) of the RTI Act states that information which cannot be denied to Parliament or state legislature cannot be denied to a citizen.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.