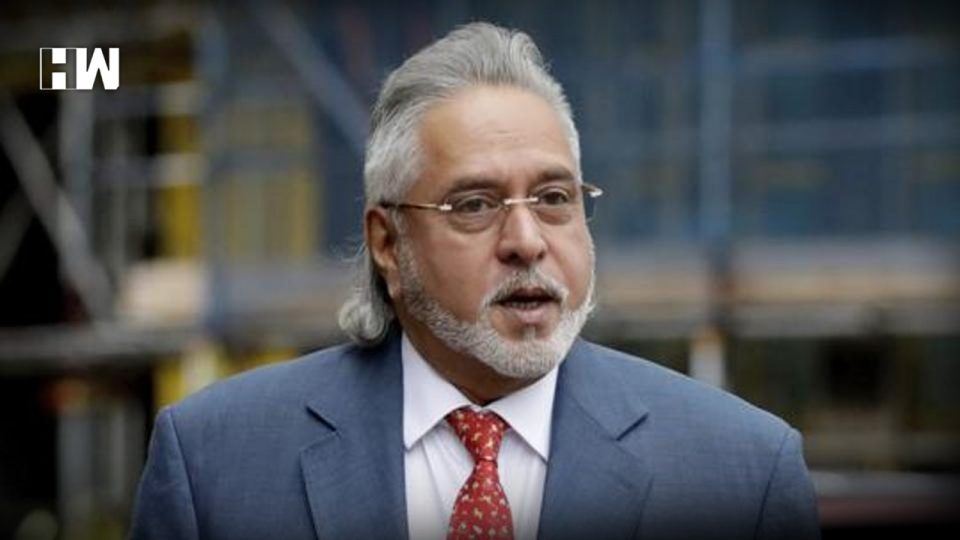

India on Friday made its first official move to clampdown against big bank loan defaulters under a new law. The Enforcement Directorate (ED) moved a court against liquor baron Vijay Mallya seeking to declare him a ‘fugitive offender’ and to confiscate his assets worth Rs 12,500 crore.

Officials said the agency filed an application before a Mumbai court under the recently promulgated Fugitive Economic Offenders Ordinance that empowers it to confiscate all assets of an absconding loan defaulter.

The application accessed by PTI seeks to immediately confiscate about Rs 12,500 crore assets of Mallya and his companies, both movable and immovable.

The ED has furnished evidence in its two charge sheets, filed under the Prevention of Money Laundering Act (PMLA) in the past, to make a case for seeking a fugitive offender tag for Mallya from the court.

Mallya is contesting these money laundering charges in London as part of India’s efforts to extradite him from there and face the legal system here in connection with an overall alleged loan default of over Rs 9,000 crore of various banks.

As per the existing process of law under the PMLA, the ED can confiscate the assets only after the trial in a case finishes which usually takes many years.

The Modi government brought the fugitive ordinance as “there have been instances of economic offenders fleeing the jurisdiction of Indian courts, anticipating the commencement, or during the pendency, of criminal proceedings,” the government said.

With Parliament being adjourned sine die, an ordinance was proposed.

The ordinance makes provisions for special courts under the Prevention of Money Laundering Act, 2002 to declare a person as a fugitive economic offender and order immediate confiscation of assets.

“A Fugitive Economic Offender is a person against whom an arrest warrant has been issued in respect of a scheduled offence and who has left India so as to avoid criminal prosecution, or being abroad, refuses to return to India to face criminal prosecution,” the government said.

Cases of frauds, cheque dishonour or loan default of over Rs 100 crore would come under the ambit of this ordinance.

The ordinance offers necessary constitutional safeguards in terms of providing hearing to the person through counsel, allowing him time to file a reply, serving notice of summons to him, whether in India or abroad and appeal before the high court.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.