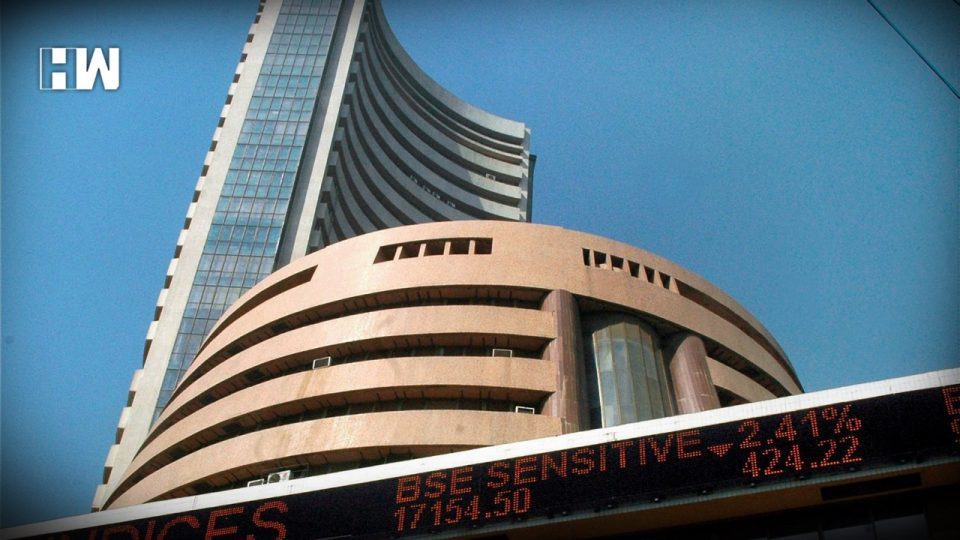

Mumbai | Indian benchmark equity indices Sensex and Nifty on Tuesday scaled new life-time closing highs as investors remained in an intense buying mode for fourth session in a row on “near-normal” monsoon forecast and bumper corporate earnings optimism.

The BSE gauge Sensex started off on a bullish note at 39,040.30 and hit a new intra-day record of 39,364.34. It, however, finally settled at 39,275.64, 369.80 points or 0.95 per cent higher, also marking its life-time closing high. The index has added 690.29 points in the last four sessions.

Similarly, the broader NSE Nifty opened higher at 11,736.20 and breached the psychological 11,800-level (intra-day) for the first time ever. The NSE barometer settled the day at a new record closing level of 11,787.15, up 96.80 points or 0.83 per cent.

Financial stocks took charge of the rally driven by sustained foreign fund inflows.

Sensex heavyweight ICICI Bank rose 3.58 per cent. In percentage terms, however, IndusInd Bank was the top gainer with 3.96 per cent rise.

Other gainers were ONGC, Larsen and Toubro, Maruti, Asian paints and HeroMoto Corp — climbing as much as 2.49 per cent.

On the other hand, PowerGrid, Tata Motors and Infosys shares booked losses.

Sectorally, among the top performers were BSE bankex, rising 1.62 per cent, finance 1.08 per cent, consumer durables 1.16 per cent and telecom 1.03 per cent.

In the broader market, BSE largecap, midcap and smallcap indices underperformed the benchmark Sensex.

However, the market breadth was tilted in favour of sellers as 1,298 stocks declined and 1,277 gained.

“Market rallied to a new high supported by optimism over quarter earnings and positive global market. A better monsoon outlook from IMD provided relief to investors, who are keen on earnings outcome to accumulate quality stocks despite election led volatility,” Vinod Nair, Head of Research, Geojit Financial Services Ltd, said.

Elsewhere in Asia, markets in Japan, China and Korea ended on a positive note.

In Europe, bourses in Germany, France and the UK were trading in the positive terrain in early deals.

Global crude oil benchmark Brent futures fell 0.11 per cent to USD 71.10 per barrel.

The Indian rupee meanwhile weakened by 18 paise to close at 69.60 against the US dollar Tuesday amid strengthening of the American currency and high crude oil prices.

Analysts also said that stocks rallied to a new high supported by optimism over quarter earnings and positive global market.

Shares of Tata Consultancy Services (TCS) have risen over 6 per cent in the last two trading sessions, after the company reported 17.7 per cent growth in consolidated net profit for March 2019 quarter.

Meanwhile, IT firm Wipro on Tuesday reported a 38.4 per cent rise in net profit at Rs 2,493.9 crore for the March 2019 quarter and also announced a Rs 10,500 crore buyback programme. The earnings numbers came after market hours.

Meanwhile, foreign institutional investors (FIIs) purchased equities worth Rs 1,038.58 crore on Tuesday and domestic institutional investors (DIIs) bought shares to the tune of Rs 37.22 crore, provisional data available with stock exchanges showed. ANS

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.