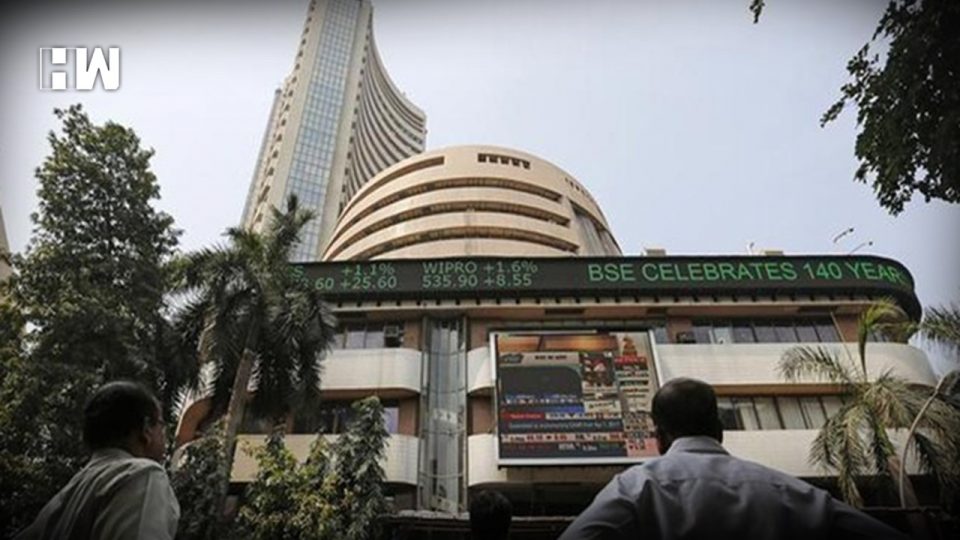

Mumbai | Market benchmark BSE Sensex cracked about 354 points on Wednesday, led by a sudden sell-off in HDFC and HDFC Bank in the later half of the session.

The 30-share Sensex index lost 353.87 points, or 0.91 per cent, to close at 38,585.35; the broader NSE Nifty dropped 87.65 points, or 0.75 per cent, to 11,584.30.

HDFC Bank lost 2.07 per cent, while HDFC slumped 1.96 per cent. The HDFC duo collectively accounted for almost half of the Sensex’s 354-point loss.

Other top losers in the Sensex pack included Bharti Airtel, Asian Paints, TCS, HCL Tech, Tata Steel, SBI, IndusInd Bank and Hero MotoCorp, declining up to 3.28 per cent.

While, Tata Motors, HUL, Kotak Bank, Coal India, Sun Pharma, M&M, Bajaj Auto and ONGC were the gainers, rising up to 4.68 per cent.

According to traders, market sentiment turned weak after the International Monetary Fund (IMF), in its World Economic Outlook (WEO), once again downgraded global growth forecast to 3.3 per cent for 2019.

The quarterly report “projects a slowdown in growth in 2019 for 70 per cent of the world economy,” IMF chief economist Gita Gopinath said in a statement.

India is projected to grow at 7.3 per cent in 2019 and 7.5 per cent in 2020, reflecting the recent revision to the national account statistics that indicated somewhat softer underlying momentum, the report said.

Meanwhile, foreign institutional investors (FIIs) purchased equity worth Rs 1,212.35 crore Tuesday, while domestic institutional investors (DIIs) sold shares to the tune of Rs 688.65 crore, provisional data available with stock exchanges showed.

Elsewhere in Asia, markets in Japan, China and Korea ended on a mixed note.

In Europe, bourses in Germany, France and UK were trading in the positive terrain in early deals.

The benchmark Brent crude futures rose 0.67 per cent to USD 71.08 per barrel.

Meanwhile, the rupee appreciated 12 paise to 69.18 against the US dollar intra-day.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.