A real clean up at Yes Bank would involve various parts. The first and easy part is to recapitalise the bank, which with the govt stepping in, is almost as easy as writing a cheque.

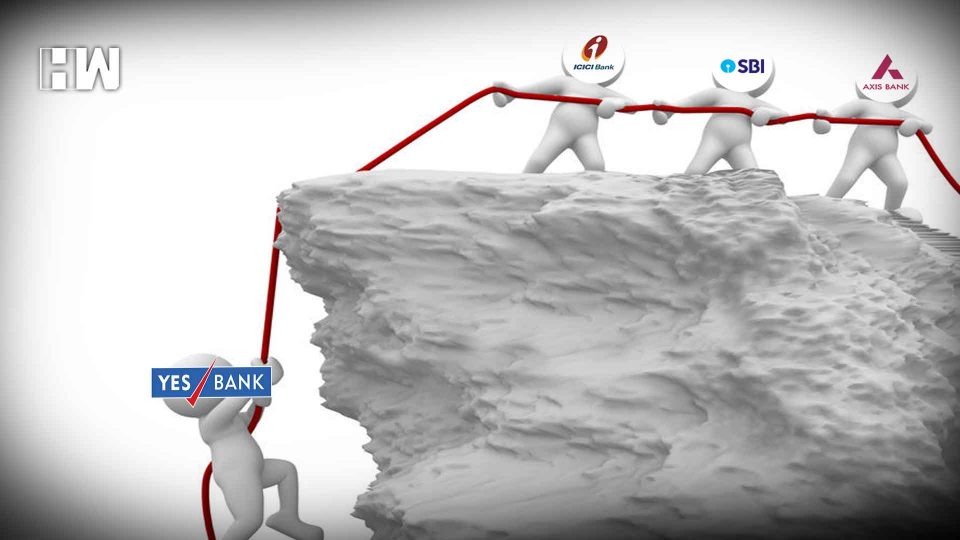

The Union Cabinet yesterday approved the ‘Yes Bank Reconstruction Scheme 2020’. To enable the infusion of additional capital in Yes Bank, the government has increased its authorised capital fivefold, from Rs.1100 crores to Rs.6200 crores. Under the approved scheme, SBI will now take a 49% equity stake in the bank for which its board has already approved an investment of Rs.7250 crores. The government has further approved an investment of Rs.1000 crores each by ICICI Bank and HDFC, Rs. 600 crores by Axis Bank and Rs.500 crores by Kotak Mahindra Bank, adding to an initial fresh capital infusion of Rs.10350 crores. All these investors are picking up a stake in Yes Bank at Rs.10 per share, as against its present market price of about Rs.25. With new owners coming on board, there will be a change in management too. In stage 2 of such recapitalisation, within six months from now, it is expected that HNIs like Rakesh Jhunjhunwala, Radhakishan Damani and the Azim Premji Trust will be permitted to invest further equity of Rs.10000 crores in the bank thus providing it with fresh capital of over Rs.20000 crores.

These investments entail a lock-in period of 3 years, which for SBI is towards 26% of its stake in the bank and for others is towards 75% of their investment in the bank. The FM said that the moratorium on the bank will be lifted on the 3rd working day after the notification of this reconstruction scheme by the government which is yet to be notified and that within 7 days thereafter, a new board of directors and CEO will be in place to manage the Bank. It is widely expected that the present administrator of the Bank Shri Prashant Kumar, who is a former CFO of SBI, will be its new CEO. The AT-1 bondholders who have gone to court challenging the write off of their entire investment by the RBI, are expected to settle matters, by converting their bonds into equity in the bank.

A massive clean up is needed at Yes Bank, to enable to a survive and go on. The Reserve Bank had to step in and impose a moratorium on the bank due to a serious deterioration in its financial health. As a result of corrupt and reckless lending by Yes Bank under Rana Kapoor’s watch, its capital stands eroded and it faces a huge mountain of bad loans to tackle. There has been a huge divergence in the bank’s reported NPAs and actual NPAs, which was the real reason why the declaration of its quarterly results for December 2019 was postponed and is expected today. Estimates say that its bad loans are to the tune of Rs.80000 crores and that at least 50% of it will have to be written off. That would mean a loss of Rs.40000 crores to be recognised by the bank, which is far in excess of the additional capital being infused at the moment, under the reconstruction scheme.

A real clean up at the Bank would involve various parts. The first and easy part is to recapitalise the bank, which with the government stepping in, is almost as easy as writing a cheque. The government is good at it. The first part of the clean up is easy and cosmetic. The others are the more difficult ones, without which no meaningful clean up would have been effected at the Bank. The other parts are about improving accountability, transparency, governance and integrity at the bank, where the government itself has a pathetic track record. The corruption, virtual absence of governance and bankruptcy of 14 PSBs bear testimony to how ill-equipped the government is here:-

- Recover the loans given and fix accountability for negligence and/or for corruption.

- Investigate the negligence of the directors, independent directors, auditors, rating agencies, valuers etc. who have been active/passive participants in this entire dubious Yes Bank case.

- Going forward to strengthen its internal controls, checks and balances, lending, procedures and follow up, vigilance and risk management to prevent a repeat of the scam.

- Improve governance and compliance at all levels. It has been a bunch of silent colluders in Yes bank, starting from Ashok Chawla its former chairman and all other bandit mates of Rana Kapoor, who have been the collective perpetrators of the Yes Bank scam. Governance was completely missing at the Bank and needs to be established.

- Punish Rana Kapoor and his direct accomplices, swiftly and severely.

The real reconstruction and clean up of Yes Bank thus does not lie just in its recapitalisation, which is merely a matter of writing a cheque, but in improving its governance, which is where the real challenge lies, particularly because the government itself is a poor role model here.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.