In the pages of India’s economic history, Urjit Patel’s appointment as the 24th Governor of the Reserve Bank of India (RBI) marked a significant turning point. However, his time at the helm of India’s central bank was marred by controversy and culminated in a surprising resignation in December 2018. Though officially citing “personal reasons” for his departure, Patel’s exit was shrouded in intricate issues that strained his relationship with the Government of India.

Urjit Patel: A Trailblazing Appointment:

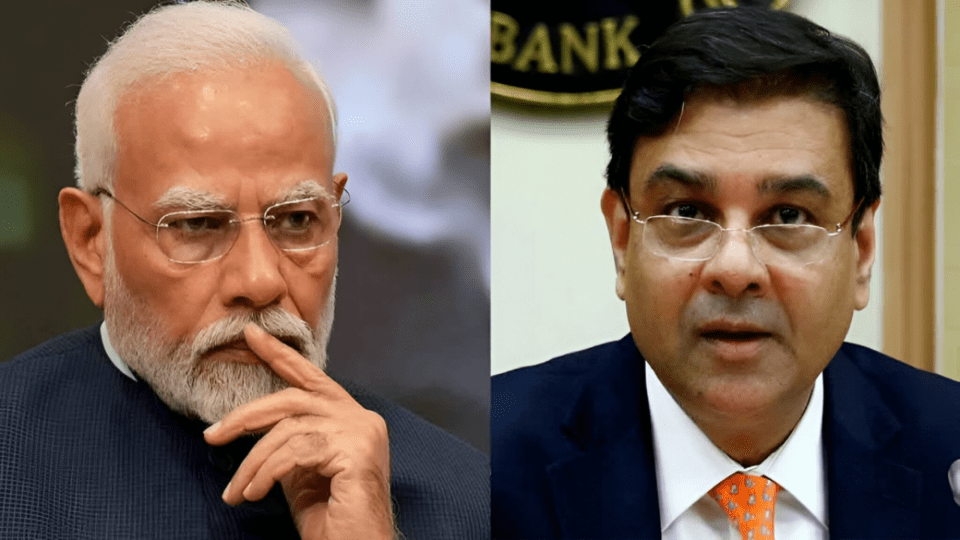

Urjit Patel’s selection as RBI Governor was historic in more ways than one. He not only assumed the role as the 24th governor but was also the first appointed by Prime Minister Narendra Modi.

The Accomplished Economist:

Before donning the mantle of RBI Governor, Urjit Patel served as the Deputy Governor of the central bank, overseeing crucial aspects such as monetary policy, economic research, financial markets, statistics, and information management.

A Resignation That Raised Questions:

Patel’s exit from the RBI in December 2018 was anything but routine. While officially citing “personal reasons,” his departure was fraught with complexity. Many experts believed it was rooted in profound disagreements between Patel and the Government of India.

Contentious Fiscal Allocations:

One major point of contention revolved around fiscal allocations. The government sought a more substantial portion of the RBI’s reserves to bridge its fiscal deficit, a proposal that Patel staunchly opposed. He argued that maintaining these reserves was paramount for the nation’s long-term financial stability.

Impact on Economic Growth:

Another source of strife was the perceived impact of the RBI’s policies on economic growth. The government believed that the central bank’s stringent measures were stifling credit growth, potentially hindering the country’s economic progress. Chief Economic Advisor Arvind Subramanian advocated for a more relaxed monetary policy to stimulate growth.

A Rift in Communication:

Tensions escalated as communication between Patel and the government deteriorated. Frustrated by what they perceived as Patel’s inflexibility, Finance Minister Arun Jaitley criticized his proposed solutions as “totally impractical and generally undesirable.”

The Electoral Bond Scheme Debate:

Patel also found himself at odds with the government regarding the Electoral Bond Scheme. He insisted that these bonds should only be issued by the RBI in digital form, a stance that directly challenged the government’s intentions.

Prime Minister Modi’s Growing Frustration:

Prime Minister Narendra Modi, who had initially appointed Patel, grew increasingly frustrated with the situation. He publicly expressed his dissatisfaction with Patel’s handling of non-performing assets, famously likening the governor to a “snake who sits over a hoard of money.” Modi accused Patel of obstructing the utilization of RBI’s accumulated reserves.

Resolution Amid Discord:

Inevitably, these differences between Patel and the government reached an impasse, culminating in Patel’s resignation. Shaktikanta Das succeeded him as the RBI Governor in 2019.

Subhash Chandra Garg’s Revelations:

Former Finance Secretary Subhash Chandra Garg’s book, “We Also Make Policy,” offers deeper insights into the strained relationship between Patel and the Modi government. It reveals that the government’s “frustration” with Patel began as early as February 2018 when Patel accused the government of failing to relinquish regulatory authority over nationalized banks, leaving the RBI with inadequate control over public-sector banks compared to private-sector counterparts.

Conflict Over Electoral Bonds:

Garg’s book also alleges that Patel attempted to derail the Modi government’s Electoral Bond Scheme by insisting that these bonds should only be issued by the RBI and in digital form.

Diverging Economic Policies:

Divergences in economic policies between Patel, then RBI Governor, and Finance Minister Arun Jaitley surfaced during a crucial meeting convened by Prime Minister Modi in September 2018. Patel proposed various solutions, including scrapping the long-term capital gains tax, expanding disinvestment targets, attracting multilateral institutions to invest in Indian government bonds, and settling pending bills of numerous companies. Frustrated, Jaitley deemed Patel’s solutions “totally impractical and generally undesirable.”

Communication Breakdown:

Garg’s book further reveals that Patel’s communication with Jaitley and the then-officiating finance minister had deteriorated to the point of breakdown. The primary channel of communication shifted to then Additional Principal Secretary PK Mishra in the Prime Minister’s Office (PMO).

The ‘Snake’ Remark:

Prime Minister Modi’s exasperation came to a head during a meeting where Patel’s presentations were met with frustration. Modi lost his temper and reportedly referred to Patel as a “snake who sits over a hoard of money.” This heated exchange, among other factors, contributed to Patel’s resignation.

Urjit Patel’s tenure as the 24th RBI Governor remains a pivotal chapter in India’s economic history. The revelations surrounding his exit shed light on the intricate dynamics of managing the country’s central banking institution and underscore the delicate balance between fiscal responsibility and economic growth.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.