On Monday, foreign investors turned net buyers after a gap of eight days of being net sellers. The foreign portfolio investors bought equities worth 590.58, according to National Stock Exchange data. Domestic institutional investors sold equities worth Rs423 crore after nine-day net buying.

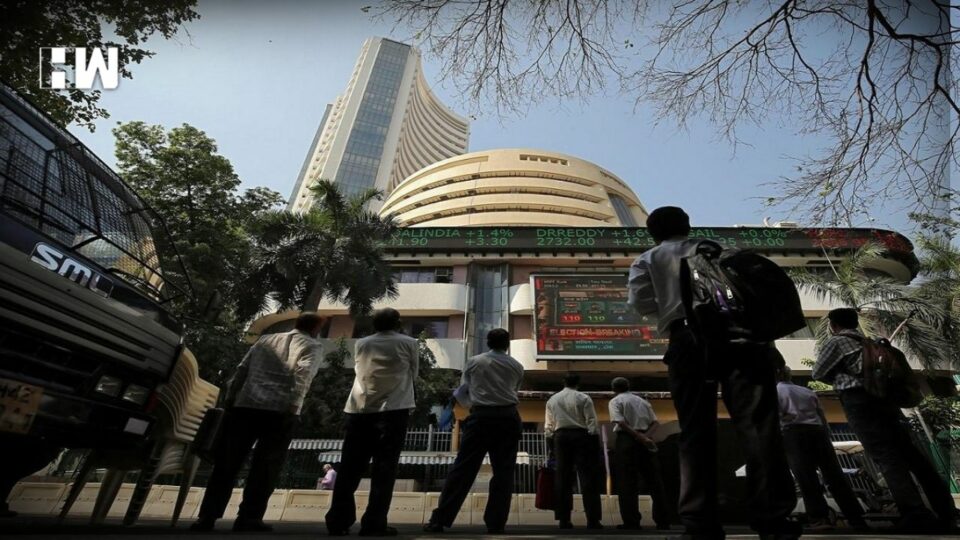

Mumbai: Indian markets started the session on Tuesday with a bullish trend, tracking strong global cues. The 30-share index rose 1,010 points, a surge of 1.78 per cent to 57,795, whereas Nifty50 went up 303 points, a 1.80 per cent surge to 17,190 levels at 9.25 IST on Monday.

Some of the gainers were JK Tyres, IndusInd Bank, Kotak Bank and M&M Financial Services whereas Lupin, Heritage Foods, Emami and Ipca Lab were among the laggards on the 30-share index. Some of the S&P BSE LargeCap stocks trading in the green today were Bandhan Bank, Bajaj Finance, Vedanta, Indigo, Eicher Motor and Adani Transmission.

Hindalco, JSW Steel, IndusInd Bank and L&T were among the most active stocks in Nifty50 index.

On Tuesday morning, Dow Jones was up 2.66 per cent to 29, 490 whereas S&P 500 rose 2.59 per cent to 3,678. Japan’s Nikkei also went up 2.38 per cent to 26,840.

Deepak Jasani, head of retail research, HDFC Securities, said: “European stock markets traded sharply lower Monday, weighed by renewed regional energy concerns, political turmoil in the UK, and worries about the health of Swiss banking giant Credit Suisse. UK’s Finance Minister Kwasi Kwarteng announced Monday that he has abandoned plans to cut the top rate of income tax, a move that had contributed towards sharp falls in the pound and UK bonds.”

Also Read:1000s From Opposition Parties March Against Hate On Mahatma Gandhi Jayanti.

Jasani said, “India’s manufacturing activity lost some momentum in September, but cost pressures continued to recede. The S&P Global India Manufacturing purchasing managers index (PMI) edged down to 55.1 from 56.2 in August,” and added that in September, purchasing costs rose at the slowest pace in just under two years, while output charge inflation receded to a seven-month low.

On Monday, foreign investors turned net buyers after a gap of eight days of being net sellers. The foreign portfolio investors bought equities worth 590.58, according to National Stock Exchange data. Domestic institutional investors sold equities worth Rs423 crore after nine-day net buying.

The yield on the 10-year bond rose 7 bps to 7.47 per cent during the session on Monday.

Benchmark BSE Sensex on Monday tumbled 638.11 points or 1.11 per cent to settle at 56,788.81. During the day, it tanked 743.52 points or 1.29 per cent to 56,683.40. Health care and telecommunication ended in the green. All the remaining indices ended in red with Bank, Auto and Metal leading the race to the bottom.

Indian currency depreciated 58 paise to 81.93, just two paise off record low 81.95, during the session. The domestic unit closed at 81.88 on Monday.

Japan’s Nikkei share average rose sharply on Monday as chip-related stocks rallied and energy shares tracked gains in crude oil prices. Hong Kong shares ended lower as investors waited for hints of a clearer direction. The Hang Seng index was down 0.83 per cent, at 17,079.51, the lowest close since April 2009. The Hang Seng China Enterprises index fell 0.97 per cent.

The international oil benchmark Brent crude futures on Monday jumped 3.90 per cent to $88.46 per barrel.

(Except for the headline, this story has not been edited by HW News staff and is published from a syndicated feed.)

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.