Petrol has become 24.7% (Rs 20.73 a litre) costlier so far this year, whereas diesel saw a surge of 26.1% (Rs 19.3 a litre) this year to date.

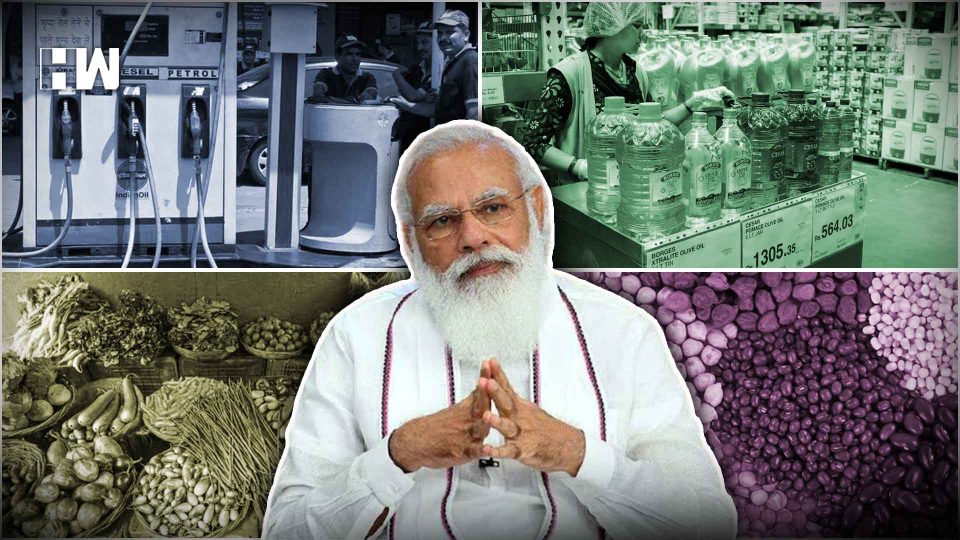

Just two days ago, the International Monetary Fund (IMF) said India’s economy is gradually recovering after it was hit by two Covid waves, but it cautioned the authorities against inflationary pressures. As Indian economy recovers in the aftermath of two waves of pandemic, inflation pressures continue to lurk around it. The government intervention in this matter, according to many experts, is selective and will not the solve the issue. Let us look at the factors contributing to the inflation and whether the government has taken enough measures to address them.

According to a report by Bloomberg Quint, since the pandemic hit the country in March 2020, the Consumer Price Index has risen 9.8% till September this year. Since the start of this year alone, the inflation build-up is 5.2%.

The specific contributors majorly responsible for this inflation build-up are oils and fats, food and beverages, vegetables, fuel and light, and transport and communication.

Oils and fats

Retail inflation in edible “oils and fats” surged to second-highest level in 2021 in September. The consumer price inflation (CPI) in oils and fats surged 34.19% in September, slightly below June’s 34.78%.

In its bid to tackle the situation, according to a release this week, the government has now imposed stock limits on inventories, scheduled to stay in place until March 31 next year.

Earlier this year, the Indian government had cut the standard rate of duty on crude palm oil, crude soya bean oil and crude sunflower oil to 2.5% in September, after a cut in August and June. As 60% of the edible oil consumed in the country is met through imports, the standard rate of duty on refined oils was also reduced.

Compared with the 34.2% rise in Oils and fats inflation on annual basis, prices rose by 2.2% in September, according to the government data. This is lower than the pace of increase seen earlier in the year.

The government intervention has certainly helped in easing the rapid rise in prices of Oils and fats. However, it has not brought down prices to pre-2021 level, let alone to pre-pandemic level. The prices of edible oil also continue to rise because of high global prices.

The high cost of Oils and fats has increased the sufferings of the middle class and poor, who have already been battered by the pandemic.

Pulses and vegetables

Between January and September, pulses was another category in which higher prices contributed 0.2% to the inflation build-up and the government had to intervene. On an annual basis, inflation in the pulses category was flat at 8.8%

The Indian government, in order to reduce pulse prices, not only issued stock limits in July but also took measures to crack down on hoarding and faster clearances of consignments.

Trade data on Sunday showed prices of vegetables, especially onion and tomato, are rising in urban areas, including the national capital. The vegetables category has a negative contribution of 0.6% to inflation between January and September, that too because of a recent fall in prices.

Data from agricultural produce market committees showed tomato prices shot up to ₹60-65 a kilogram (kg), while onions were selling for ₹50-55 in Delhi, Patna, Kolkata and Mumbai, up by ₹20-25.

The government is trying to stabilize the prices of onions since its prices often stoke food inflation and impact monthly budgets of consumers, poor or rich, as it is a base ingredient of most Indian dishes. The government has tried stabilizing prices by offloading buffer stock. A press release by the Ministry of Consumer Affairs, Food & Public Distribution, published on Sunday said the Department of Consumer Affairs has taken up calibrated and targeted release of onions from the buffer on First-in-First-Out principle commenced from last week of August, 2021.

Onion inflation showed signs of a reversal, falling by 9.6% annually in September, compared to a rise of 24% in August. However, the prices have been rising again due to higher fuel prices and damage to summer crops because of heavy rain.

Fuel and transportation

After increase in rates of fuel for the court consecutive day, petrol and diesel cost ₹105.84 per litre and ₹94.57 per litre respectively in the national capital Delhi.

After the three-week long hiatus in rate revision ended in the last week of September, this is the 16th increase in petrol price and the 19th time that diesel rates have gone up.

Of a rise of 5.2% in the index, a total of 1.5% came from transport and communication, and fuel and light. While transport and communication contributed 0.9%, fuel and light contributed 0.6% to the inflation build-up.

Retail prices of fuel and LPG continue to rise because of absence of intervention from the government.

Petrol has turned 24.7% (Rs 20.73 a litre) costlier so far this year, while diesel has surged 26.1% (Rs 19.3 a litre) year to date. For a consumer, an LPG refill has turned Rs 205 (or 29.5%) costlier since January. In major parts of the countries, petrol has crossed the Rs 100-mark, whereas diesel rates have crossed that level in a dozen states/UT including Madhya Pradesh, Rajasthan, Odisha, Andhra Pradesh, Telangana, Gujarat, Maharashtra, Chattisgarh, Bihar, Kerala, Karnataka and Ladakh.

Though the recent hikes post September can also be attributed to the surge in international oil prices, the prices had already reached beyond Rs 100 for petrol in many cities.

The rise in fuel prices have ultimately impacted the transportation costs, and likely to do so until the government intervenes to control prices.

Excise duty imposed by the central government on fuel is a major factor in high rates. A Rs 5 reduction in petrol and diesel excise duty will reduce retail prices by about 5-5.5% at current levels, according to estimates by Yuvika Singhal, economist at QuantEco Research, Bloomberg Quint reported.

Long path to recovery

Though the GDP has shown significant gains towards the return to pre-pandemic level , the high inflation has ensured that common man does not get a respite. The rising prices of oil, vegetables and fuel have severely impacted the budget of the middle class and poor.

The government’s approach has showed that while it has stepped in to bring down costs across sensitive food items, it has refused to yield to calls for intervention on fuel prices.

Even a reduction of Rs 5 in excise duty on fuel will have a direct impact of about 8-10 basis points of softening on both CPI and WPI inflation, said Yuvika Singhal’s notes, according to Bloomberg Quint. “As such, potentially a cumulative 15-20 basis points of moderation on both retail and wholesale inflation can be effected,” she estimated.

Though the petroleum products are a critical source of revenue for the government, it can profit from duty cuts on fuel. The duty cuts on fuel can have cascading effects that will not only help government in increasing the GDP and also controlling the inflation at the same time.

However, if the government refuses to make intervention to reduce fuel prices, the road to economic recovery will be very long and perhaps will lead to more difficult times.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.