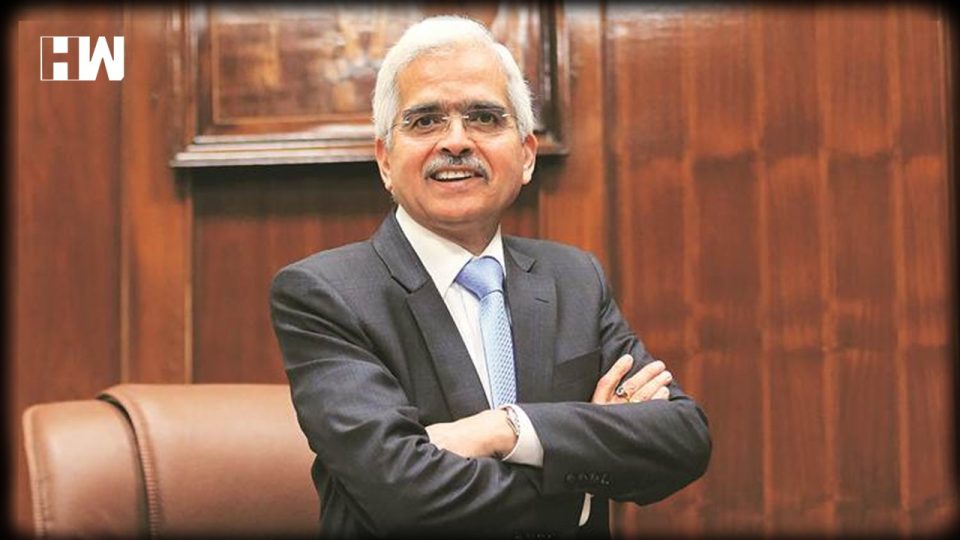

RBI governor Shaktikanta Das said that the Gross Domestic Product (GDP) is projected to remain negative in the first half of the current financial year.

Mumbai| The Reserve Bank of India (RBI) has not changed key lending rates, allaying all the fears. Addressing a press conference on Thursday, Governor Shaktikanta Das said the Monetary Policy Committee (MPC) has decided to keep the repo rate unchanged at 4 per cent. Das said that the MPC has taken this decision unanimously. Besides, the reverse repo rate has been maintained at 3.35 per cent, marginal standing facility rate at 4.25 per cent and bank rate at 4.25 per cent.

Signs of recovery in the economy in May-June

Speaking at a press conference, Governor Shaktikanta Das said the economy was showing signs of recovery in May and June. Shaktikant Das said that not all members were in favour of a change in policy rates. He said that due to better monsoon, growth is expected in the Agri sector. Imports have been declining due to weak domestic demand.

Also Read: India’s GDP growth overestimated by 2.5%, says Modi govt’s former chief economic adviser

Statement on Developmental and Regulatory Policies

@DasShaktikanta #rbitoday #rbigovernor #monetaryPolicy https://t.co/FUMh9fdLve— ReserveBankOfIndia (@RBI) August 6, 2020

Other special things

- Inflation is expected to decline in the second half of FY2021.

- Global economic activity remains fragile due to the increasing cases of Covid-19.

- Economic activity had begun to improve, but the lockdown due to the transmission has put a brake on activity.

- The supply chain is interrupted. Inflation is evident in all segments.

- From April 2020, economic growth will decline in the first half of the current financial year.

- Food and drink inflation is expected to rise.

- Special additional liquidity facility of Rs. 10,000 crore to NABARD and National Housing Bank.

- Recent austerity efforts have boosted the economy.

- Mutual funds also benefited from adequate liquidity.

- Stressed MSMEs will get the benefit of loan restructuring scheme till March 31, 2021.

- A special window will be provided for restructuring of some loans.

- Loan restructuring facility will be provided under the rules announced in June 2019.

- Gross Domestic Product (GDP) is projected to remain negative in the first half of the current financial year.

- GDP is likely to remain negative in this financial year ending March 2021.

- By March 31, 2021, gold lending banks can lend up to 90 per cent. So far this limit was 75 per cent. This is called Loan to Value (LTV).

- The next meeting of the MPC will now begin on September 29.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.