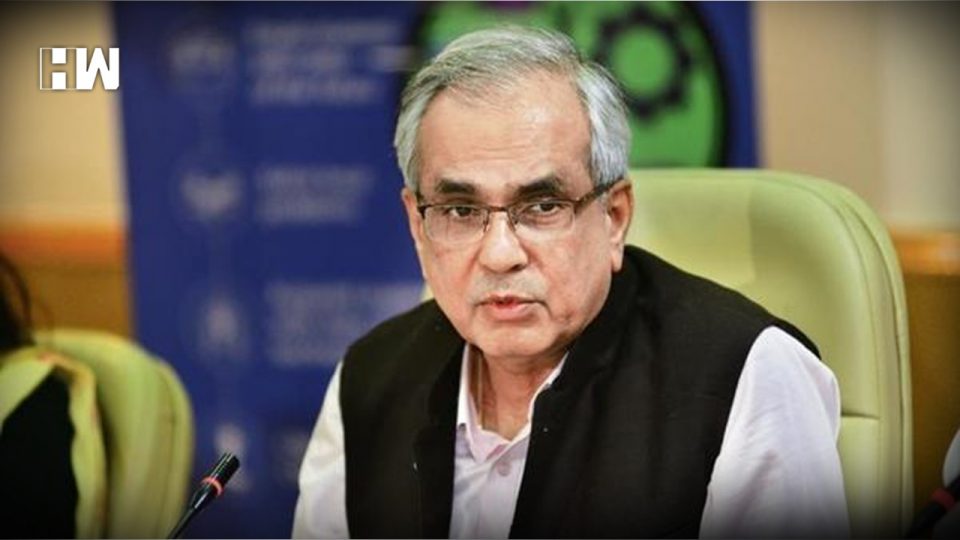

“No one is willing to give loans within the private sector, everyone is sitting on cash,” NITI Aayog Vice-Chairman Rajiv Kumar said.

New Delhi| In a scathing criticism of the government, NITI Aayog Vice-Chairman Rajiv Kumar has said that India is witnessing crisis never seen before. He said there is a huge liquidity crisis in India and the entire financial system is at risk. He said, “From last 70 years, we have not faced this sort of liquidity situation where the entire financial sector is in churn.” According to him, the crisis has deepened especially after demonetization and GST.

Rajiv Kumar further said that today the entire financial sector is churning and no one is trusting anyone. “No one is willing to give loans within the private sector, everyone is sitting on cash,” he said. Rajiv Kumar advised the government to take some steps out of the box. According to Rajiv Kumar, after demonetisation, GST and IBC (insolvency law), the situation has changed. Earlier about 35 per cent cash was available, now it has reduced considerably. For all these reasons, the situation has become quite complicated.

#WATCH: Rajiv Kumar,VC Niti Aayog says,"If Govt recognizes problem is in the financial sector… this is unprecedented situation for Govt from last 70 yrs have not faced this sort of liquidity situation where entire financial sector is in churn &nobody is trusting anybody else." pic.twitter.com/Ih38NGkYno

— ANI (@ANI) August 23, 2019

His statement comes at a time when India is facing a major economic slowdown. Employees in several sectors are on the verge of losing their jobs. Recently, the auto sector around 2.30 lakh auto sector jobs have been lost which saw its sharpest fall in last 19 years. Almost 15,000 jobs, mostly temporary and casual workers, have already been lost in the automobile manufacturing companies over the last two to three months. Around 100 million workers in the textile industry face an uncertain future.

The result of thoughtless lending

Regarding the slowdown in the economy, Rajiv Kumar said that this is the result of a thoughtless loan during 2009-14. This led to the increased non-performing asset (NPA) after 2014. Due to this, the ability of banks to give new loans has reduced. Non-banking finance companies (NBFCs) made up for this deficiency. Their debt increased by 25 per cent. However, he also said that some steps have been announced in the Union Budget to deal with the pressure in the financial sector and speed up economic growth.

Profits are mine but losses are of govt, mindset has to be changed: K. Subramanian

Recently Chief Economic Advisor K. Subramanian has asked the private sector companies to change the mindset. Subramanian told the private companies that an adult cannot continuously ask for help from his father. Similarly, you also have to change this thinking. You cannot keep thinking that I grab the profits myself and if there is a loss, then I should put my burden on everyone.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.