So far we have got a net collection of about Rs 4.80 lakh crores. Our gross collection is 38 per cent more than last year. 31st July was the last date of Income Tax return filing.

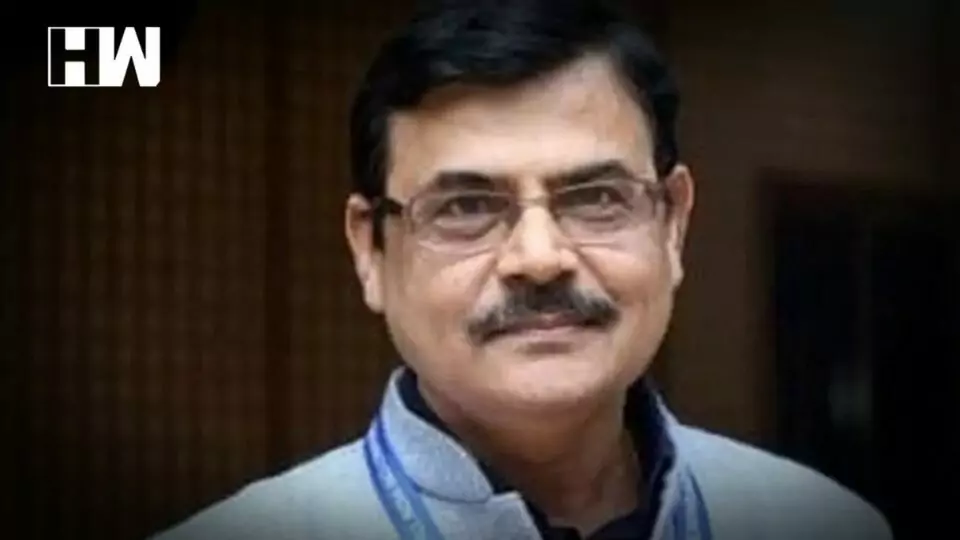

New Delhi: Raids, searches, surveys and notices conducted by Income Tax authorities are always based on credible information, said Nitin Gupta, new Chairman of the Central Board of Direct Taxes (CBDT). Gupta was appointed Chairman of CBDT, the apex body of the Income Tax Department on June 27, 2022.

“Our search or action is based on credible information. When we get credible information that someone or any entity is evading tax, then it is our duty to take appropriate action,” Gupta told ANI in an exclusive Interview.

The Chairman said he was confident enough about achieving the direct tax collection target set in the Budget announced by Finance Minister Nirmala Sitharaman.

Also Read:Legends League Cricket: Adani Group Gets Franchise, Names it Gujarat Giants

Gupta said that a target of Rs 14.20 lakh crores has been set in the Budget and the current trend of direct tax collections is very encouraging.”So far we have got a net collection of about Rs 4.80 lakh crores. Our gross collection is 38 per cent more than last year. 31st July was the last date of Income Tax return filing. This time we have not extended the date.”As of today, about 6 crore returns have been filed and we have issued the refund amount to 68 per cent more than we did last year. Our effort is to issue the refund as early as possible. So far we have issued a refund of Rs 93,000 crores against Rs 52,000 crores last year.”

He was hopeful that the direct tax collections will exceed the Budgeted target.

“The September collection figure would be a good indicator of the likely full year performance,” he added.

In reply to a question on the income tax portal, Gupta said that the new income tax portal is working very smoothly. He said that on July 31, 5.17 lakh returns were filed just between 5:00 and 6:00 PM. “This shows that our online portal was doing a good job for us. The experience of taxpayers of return filing was very good.”

Talking about the faceless scheme, Gupta said, “We are constantly trying to make the scheme more assessee friendly. We have taken 3-4 initiatives and issued a detailed Standard Operating Procedure(SOP) for our officers. We have given an option to assess for appearing through Video Conference virtually. We have also formed 20 committees which will be monitored by CBDT.”

Further, reacting to the Supreme Court’s decision on Benami Act, Gupta said, “We are studying and analyzing the decision given by the Supreme Court. The order has just come and we are in the process to analyze it.”

(Except for the headline, this story has not been edited by HW News staff and is published from a syndicated feed.)

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.