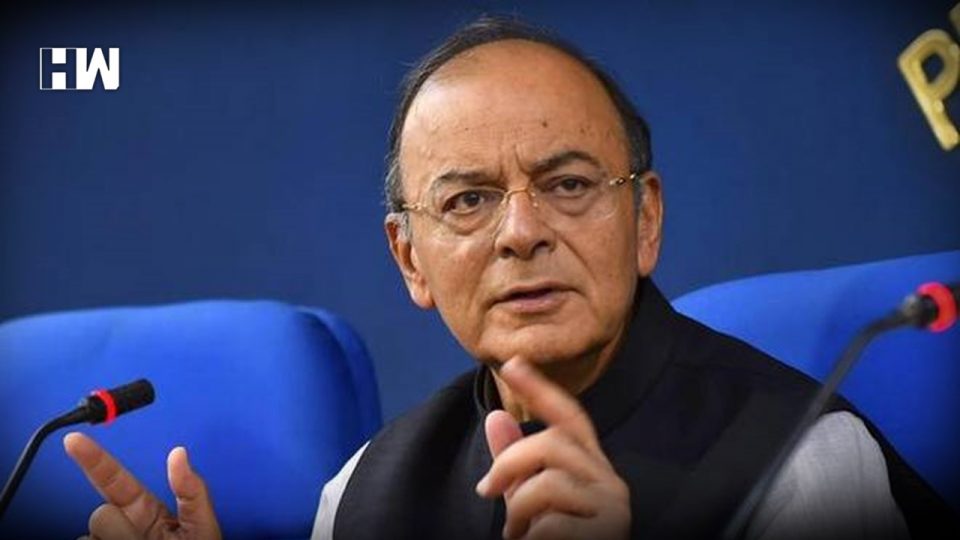

New Delhi | Following the resignation of Dr. Urjit Patel from the post of RBI Governor Arun Jaitley thanked Patel for his services by expressing gratitude for his services.

Taking on Twitter Jaitley wrote,”The Government acknowledges with deep sense of appreciation the services rendered by Dr. Urjit Patel to this country both in his capacity as the Governor and the Deputy Governor of The RBI. It was a pleasure for me to deal with him and benefit from his scholarship”. He further added,”I wish Dr. Patel all the very best and many more years of public service”.

The Government acknowledges with deep sense of appreciation the services rendered by Dr. Urjit Patel to this country both in his capacity as the Governor and the Deputy Governor of The RBI. It was a pleasure for me to deal with him and benefit from his scholarship. (1/2)

— Arun Jaitley (@arunjaitley) December 10, 2018

Urjit Patel on Monday resigned from the post of Reserve Bank of India (RBI) governor. Patel’s three year team was to end in September 2019. Patel is also the first RBI governor to resign since 1990.

Submitting his resignation, Urjit Patel cited personal reasons and stepped down with immediate effect. He said, “On account of personal reasons, I have decided to step down from my current position effective immediately. It has been my privilege and honour to serve in the Reserve Bank of India in various capacities over the years,” Urjit Patel said in a statement. “The support and hard work of RBI staff, officers and management has been the proximate driver of the Bank’s considerable accomplishments in recent years. I take this opportunity to express gratitude to my colleagues and Directors of the RBI Central Board, and wish them all the best for the future,” he added.

RBI Governor Urjit Patel earlier appeared before a parliamentary panel to brief on demonetisation and NPA situation in the public sector banks, among other issues. The RBI Governor appeared before the panel days after the central bank’s face-off with the finance ministry over issues ranging from appropriate size of reserves to be maintained by RBI to easing of lending norms for small and medium enterprises.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.