Mumbai | The Maharashtra government today said that it would increase the E-way bill generation criteria for goods from the present threshold of Rs 50,000 to Rs 1 lakh, state Finance Minister Sudhir Mungantiwar said today.

The E-way bill, an electronic system, has to be generated by traders when they have to move their goods within the state or outside.

This change, officials said, would mean that goods having a value of less than Rs 1 lakh need not have a E-way bill when they are transported within Maharashtra.

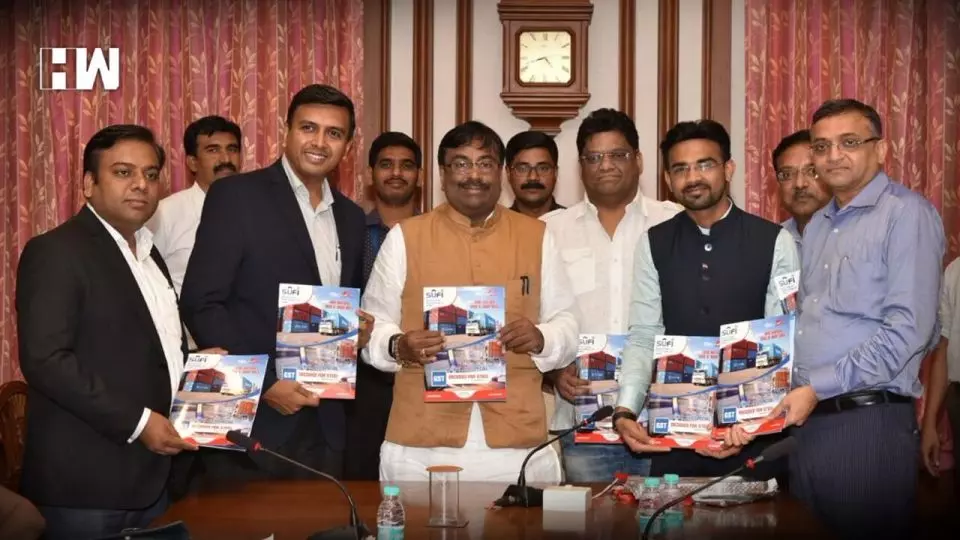

Mungantiwar was speaking at a function organised to commemorate the first anniversary of the implementation of the Goods and Services Tax mechanism across the country.

“It is a day of celebration and I have good news for traders. The intra-state transport E-way bill limit will be revised (from the current Rs 50,000) to Rs 1 lakh,” he told the gathering.

The minister said that the E-way bill system had been effective in curbing evasion of stock and material as it could track these items from source to destination.

Speaking on another issue, of state GST officials demanding pay parity with their Central GST counterparts, the minister said that steps would be taken in this connection.

“The state government will take steps to bring salary parity between state and Central officials,” he said.

A presentation made on the occasion by state GST officials showed that Maharashtra’s share of the total E-way bills generated across the country, which stood at 3.76 crore, was 18 per cent.

According to the presentation, tax collection in the state during the fiscal 2016-17 was Rs 90,525.19 crore which increased, post the implementation of GST last year, by 28 per cent to Rs 1,15,940.23 crore.

In the first quarter of FY 2018-19, Maharashtra collected Rs 35,915 crore in tax, which was a 39.5 per cent increase from the amount collected in the corresponding period in the previous fiscal.

The presentation mentioned that the total number of tax payers in Maharashtra stood 14,44,574 of which 9.55 lakh are with state GST and rest with Central GST.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.