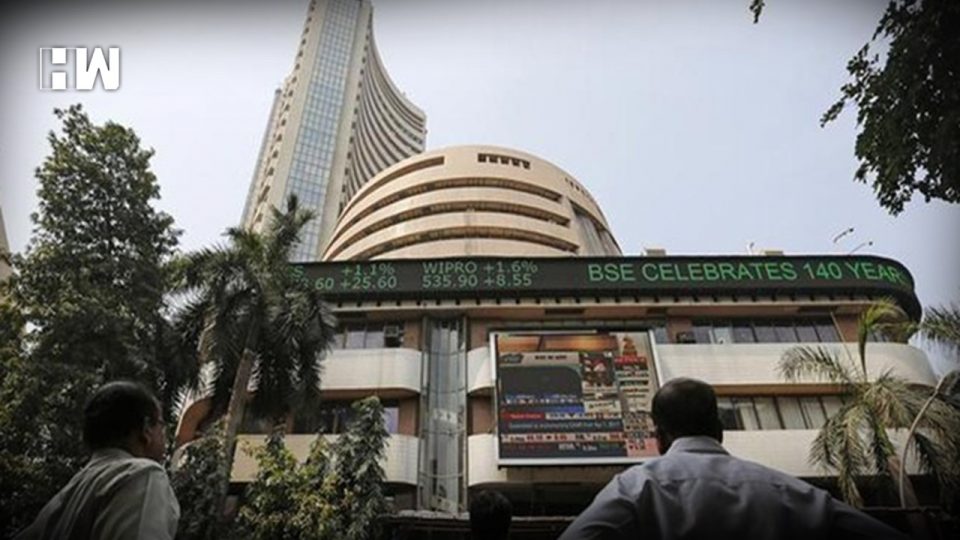

Mumbai | Equities benchmark Sensex edged lower by over 50 points in early trade on Tuesday, tracking weak global cues amid caution on the US-China trade talks front and concerns over slowing Chinese economy.

The 30-share BSE index was trading lower by 0.14 percent, or 50.71 points, at 36,013.10 in the opening trade. The broader NSE Nifty was also quoted down by 0.13 percent, or 14.60 points, at 10,848.90.

In the Sensex pack, weakness was seen primarily in capital goods, IT and financial counters. Indian equities followed the weak trend prevailing on Asian bourses as investors awaited fresh developments in the China-US trade talks. China lowering its growth forecasts for this year also played in the minds of cautious investors.

Globally, investors tracked losses on Wall Street, where the global rally hit a bump as optimism that the world’s top two economies are heading for a tariffs deal was replaced by a need for clarity on any agreement.

In Asia, Shanghai was down 0.2 percent while Hong Kong slipped 0.6 percent and Tokyo was 0.6 percent lower. Back home, the Sensex on Friday closed with 196 points gain to end at 36,064 and also posted its second straight weekly gains amid signs of easing tensions between India and Pakistan.

However, volatility erupted last week on domestic bourses after the Indian Air Force targeted Pakistan-based terror camps, leading to days-long geo-political tensions in the region. But investors now can heave a sigh of relief amid subsiding of skirmishes on the border between the two nations.

In the absence of any immediate key triggers, the domestic equity market would be guided by macro-economic data, crude oil prices, foreign fund inflows and currency movement in this holiday-shortened week, according to analysts.

Meanwhile, China has slashed its official GDP target to 6 to 6.5 percent this year as the world’s second largest economy grapples with the ongoing trade war with the US and a continued economic slowdown.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.