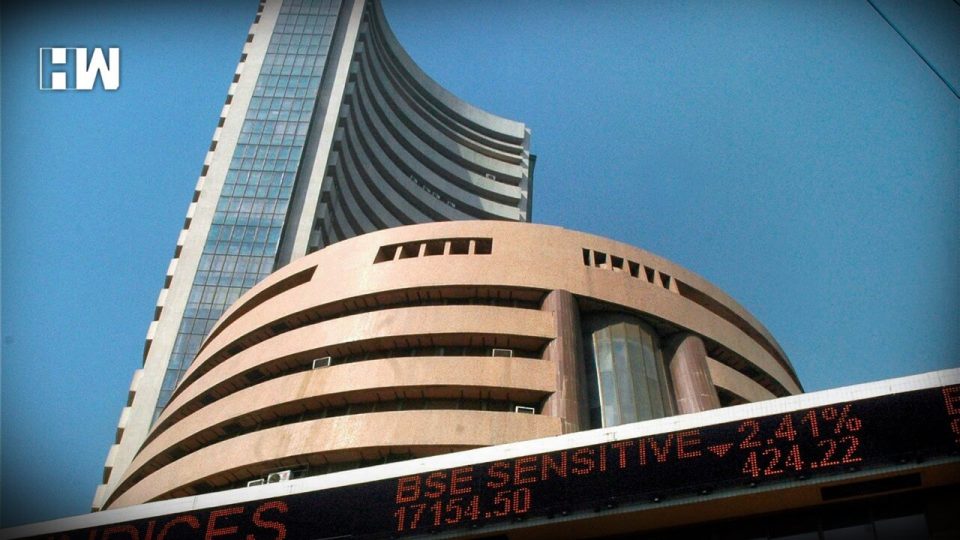

Today, on the first day of the week, the BSE Sensex was seen trading at a level of 48,786.03, falling by 805.29 in the morning, which is a fall of around 1.62 per cent.

Mumbai| The stock market plunged more than 1600 points due to rising cases of coronavirus and the possibility of a lockdown. The Sensex is trading down by 1629.14 points, or 3.29 per cent, to trade at 47,961 levels amid negative global cues and rising cases of Covid-19 infection in the country, with large stocks such as HDFC, ICICI Bank and Reliance Industries falling.

Today, on the first day of the week, the BSE Sensex was seen trading at a level of 48,786.03, falling by 805.29 in the morning, which is a fall of around 1.62 per cent. At the same time, the NSE Nifty was trading 268.05 points, or 1.81 per cent, at the level of 14,566.80. In Sensex, all the stocks except Infosys are trading at the red mark.

Sensex down by 1186.95 points, currently at 48,404.37 pic.twitter.com/5hQrDYqiwr

— ANI (@ANI) April 12, 2021

IndusInd Bank fell the most by eight per cent in the Sensex. Among the Sensex companies, Bajaj Finance, Ultratech Cement, NTPC, Axis Bank, ICICI Bank, IndusInd Bank, Reliance Industries, L&T, Sun Pharma, Hindustan Unilever, Tech Mahindra, Dr Reddy’s and HDFC Bank are among the losers. At the same time, only Infosys is on the green mark.

VK Vijayakumar, the chief investment strategist at Geojit Financial Services, said the second wave of the epidemic is worsening more than anticipated, so there is uncertainty about its impact on the economy and markets. He said that the situation is worst in economically important Maharashtra, which could affect the market growth of around 11 per cent GDP and income growth of more than 30 per cent.

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.