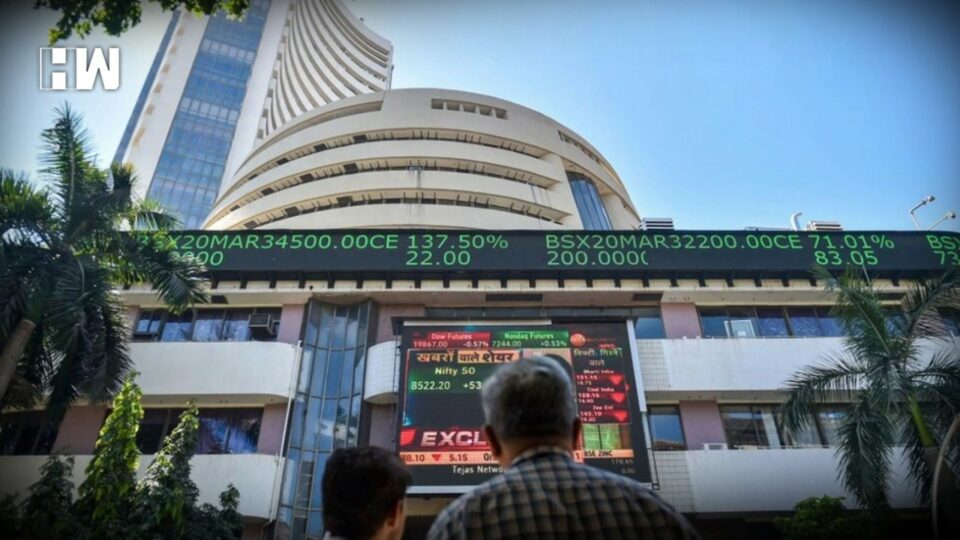

New Delhi: Indian stock markets opened the new week with gains as investors picked up positive cues from strong overseas markets.

On Friday, US data showed inflation was continuing to ease – annual inflation reportedly increased at its slowest pace in 13 months, besides the US Federal Reserve’s rate hikes were serving their purpose. Sensex closed Monday’s session at 60,566.42 points, up 721.13 or 1.20 per cent, whereas Nifty closed at 18,014.60 points, up 207.80 points or 1.17 per cent.

Among the Nifty 50 stocks, SBI, Indusind Bank, Hindalco, Coal India, and Bajaj Finserv were the top five gainers, while Cipla, Divi’s Labs, Dr Reddy’s, Nestle India, and Kotak Mahindra Bank the top losers, National Stock Exchange data showed.

“Markets started the week on a strong note and gained over a per cent, taking a breather after the recent slide. After the initial uptick, the Nifty index gradually inched higher as the day progressed. However, some profit taking in the last half an hour trimmed some gains,” said Ajit Mishra, VP – Technical Research at Religare Broking.

“Participants shouldn’t read much into a single-day rebound and wait for the sustainability of the move,” Mishra added.

The benchmark stock indices – Sensex and Nifty – had witnessed losses for four days.

Also Read: “While K’taka CM Is Aggressive, Shinde Is Silent”: Uddhav Thackeray’s Jibe At Maha CM Over Border Dispute

“After a four-day selloff, the domestic market was refuelled by bottom fishing and optimistic sentiment from global counterparts. PSBs led the rally, while mid-and small-cap stocks outpaced the benchmark. Contrary to the trend, global concerns over the recession and COVID spread continue to remain high, which will sustain volatility in the market,” said Vinod Nair, Head of Research at Geojit Financial Services.

Meanwhile, Rupee closed at 82.65 against the US Dollar versus Friday’s closing of 82.86.

Jateen Trivedi, VP Research Analyst at LKP Securities, said, the rupee appreciated as the global markets were closed and anticipated dollar weakness and strong capital market participation.

“Due to holiday mood, low participation was seen across the FX board hence rupee saw positive trades on non-participation from dollar buyers,” Trivedi said, adding that the Rupee can now be seen between 82.25-83.00.

(Except for the headline, this story has not been edited by HW News staff and is published from a syndicated feed.)

As an independent media platform, we do not take advertisements from governments and corporate houses. It is you, our readers, who have supported us on our journey to do honest and unbiased journalism. Please contribute, so that we can continue to do the same in future.